More now than ever, investors would rather spend $80 for a share’s worth of a decidedly successful business than buy $180 worth of stock in a scandalous company with a poor balance sheet. A cheap stock purchase can allow one to be conservative with their investment while enjoying the potential it has—for example, if we’re talking about a stock that’s undervalued and is also expected to grow, then you combine those two with the eventual market recovery and shareholders could see big profits.

The trading method referred to as “buying the dip” should be used with caution since there isn’t quite a science to it. If you play your cards well, you can get a sizable discount on equities with the right business fundamentals and promising futures. The fact is that many outstanding businesses may see short-term drops, but they tend to outperform over the long run. I’ve looked through many stocks that would be considered “cheap.” Don’t panic; they’ll likely be worth a lot more in the future. That’s the point.

Join me while I break down three “cheap” stocks. These are stocks with solid fundamentals and are likely to rebound soon. The consensus among experts tells us the same as the buy ratings do. Now, let’s have a look at these time-appropriate tickers:

Builders FirstSource Inc (BLDR)

Builders FirstSource, Inc. (BLDR) manufactures and distributes building materials, manufactured components, and construction services in the U.S. to professional homebuilders, subcontractors, and consumers. BLDR provides lumber and sheet goods, including dimensional lumber, plywood, and strand board materials used in on-site home building; roofing, gypsum, and insulation products; siding, metal, and wood siding products. Other building materials and services offered by BLDR include cabinets and hardware, turnkey framing, and expert installation. BLDR, formerly BSL Holdings, Inc., was formed in 1998 and is headquartered in Dallas, Texas.

BLDR shares have grown 204% over the past five years, yet it is currently down by 34.03%, an appropriate display of how it’s sitting below fair value. Drops of 30% or more have offered excellent entry chances during the past ten years. Since 2016, BLDR has grown its EPS and sales annually, with 3-year average annual growth rates of 94.9% and 44.9%, respectively. Over the next five years, analysts predict an estimated yearly EPS growth of 18.8% for BLDR. BLDR performs remarkably against quarterly earnings projections; In Q1 ‘22, BLDR surpassed analysts’ forecasts on EPS by 105.70% and revenue by 24.71%; Q2 ‘22: 93.07% and 21.17%, respectively. BLDR shows healthy year-over-year growth across the board. BLDR has a median price target of 86.50, with a high of 125.00 and a low of 75.00, as recorded by the analysts that offer yearly price projections. Taking everything into account, BLDR’s badass buy rating is starting to feel relatable.

Asbury Automotive Group Inc (ABG)

Asbury Automobile Group, Inc. (ABG) and its subsidiaries are automotive retailers (collectively) in the U.S. ABG specializes in automotive services and products, such as new and used automobiles, as well as vehicle repair and maintenance and accident repair services. ABG offers financial and insurance products, such as third-party car financing, contracts, a debt cancellation service, and life and disability insurance. As of the end of 2021, the firm owned and operated 205 new car franchises representing 31 automobile manufacturers at 155 dealership sites in the U.S., along with 35 repair facilities. Asbury Automotive Group, Inc. was established in 1996 and is based in Duluth, Georgia.

ABG’s stock dropped by over 70% in the early 2020 market crisis; pullbacks (dips during an upward trend) of more than 25% have traditionally provided an excellent long-term opportunity to buy the dip. Well, ABG has been performing much better than it was a little more than two years ago. Analysts anticipate 18.5% annual EPS growth over the next five years. Being a positive outlook, perhaps they’re used to having their quarterly EPS projections surprised by ABG. I usually don’t bring these in as critical stats, but I’m evolving. Given the excitement, I’ll let it out bluntly just for now. ABG is a $3.3 billion market-cap firm with a trailing P/E ratio of 4.8 with a forward of 4.9. I don’t often refer to them, but these numbers are intriguing when I look at the price. For the present quarter, ABG has a stunning EPS forecast of $8.34 per share. From the analysts who provide 12-month pricing estimates, ABG has a consensus median price target of 225.00, with a high of 368.00 and a low of 135.00. This is a 44.38% increase from current pricing, and ABG’s buy rating is also part of the analyst consensus.

Entegris Inc (ENTG)

Entegris, Inc. (ENTG) manufactures equipment and systems that clean, preserve, and transport crucial elements to create semiconductors and related devices. In the U.S., Canada, Taiwan, Ireland, Singapore, Malaysia, China, Isreal, France, Germany, Korea, and Japan, ENTG employs around 5,800 people in manufacturing and research facilities. ENTG aims to assist manufacturers in production by enhancing pollutant control in various vital processes, including photolithography, bulk chemical processing, wafer handling, and shipping. The semiconductor sector currently uses around 80% of ENTG’s goods. ENTG was founded in 1966 and is headquartered in Massachusetts.

ENTG has a history of success, but the stock has been down by over 50% year-to-date. Keep in mind, however, that this is after having increased by 212% during the previous five years. Since this current drop is a substantial decline for ENTG, long-term value investors may find this to be an excellent time to consider throwing a few chips in. Recent EPS growth, revenue growth, and net income growth for ENTG have all been increasing at rates close to 17% annually. Here’s a fun little piece of data I found while looking into ENTG’s financials: The last recording of year-over-year growth shows a “Net Change in Cash” growth of 1,720.82%. ENTG currently has a dividend yield of 0.63%, with a quarterly payout to shareholders of 10 cents per share (A tiny bit cheap, perhaps, but so is the stock). According to analysts who provide annual consensus pricing estimates, ENTG has a median price target of 100.00, with a high of 145.00 and a low of 80.00. This estimate shows a 57.78% increase from current pricing, giving us just one more reason to warm up to ENTG’s buy rating.

Read Next: America is going mad—is this next?

America is definitely going a little mad…

Some states are threatening to break away. The rich are fleeing. The wealth gap is soaring.

According to a recent article in the New York Times, people are driving more recklessly than ever… and drinking more alcohol than ever too.

And that’s just the beginning…

Altercations on airplanes are now at all-time highs. So are murder rates. And violent crime is soaring across the board. Students are more disruptive than ever. Hate crimes have hit a 12-year high, according to the FBI.

The question of course is:

Where is this all headed… and what’s coming next?

Well, one of the wealthiest and most successful entrepreneurs in America has a very clear answer you’re unlikely to hear anywhere else…

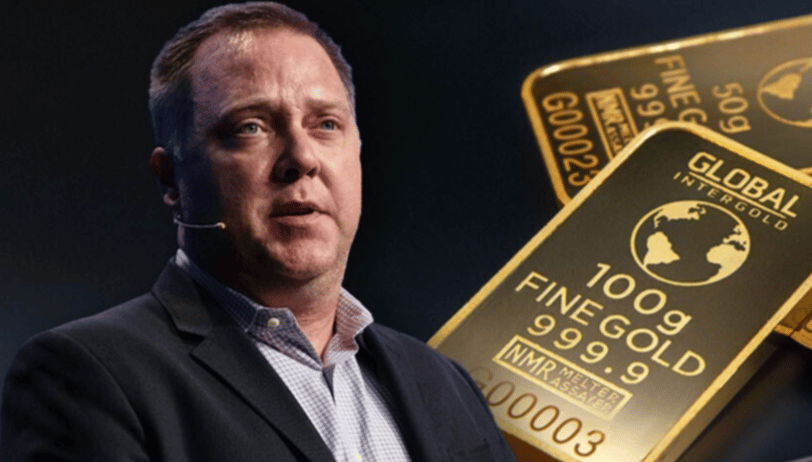

Bill Bonner is a 73-year-old son of a tobacco farmer, who now owns six large properties in South America, Central America, and the U.S… plus three in Europe.

Bonner is also one of the most humble and thoughtful men in the world today. He’s the author of three New York Times bestsellers… and has built several homes with his own hands, using ancient building techniques.

I’m telling you about Bonner today because has just come forward with an important message…

What he calls: His 4th and Final Warning.

It’s worth paying attention to, because Bonner has made 3 other big macro-economic predictions in his career… and each one proved to be exactly right.

Today, Bonner says we are headed towards a very difficult period in the U.S.… one of our most difficult times ever… which will result in something he calls: “America’s Nightmare Winter.”

What does that mean, exactly—and how could it affect you and your money?

Bonner doesn’t claim to have all the answers–but he recently went public with the fascinating analysis, recorded at his 60-acre property overlooking one of Europe’s most beautiful rivers.

He says:

“I believe it falls on someone like me to warn people… clearly… and without distraction.

“I can do this now because I’m too rich to care about money… and too old to care about what anyone says about me.”

And in this analysis, Bonner explains exactly how he believes this difficult period will play out, and even more important: The 4 Steps every American should take right now to prepare.

Get the facts.

Learn how to protect yourself and get a peek inside Bonner’s spectacular European property.

We’ve posted Bonner’s full analysis and his 4 recommended steps on our website.

You can view it free of charge here…