Snapchat’s parent company Snap, Inc. (SNAP), saw its stock plunge more than 25% on Monday after CEO Evan Spiegel told staff in a memo that the business would fail its sales and adjusted profits forecasts in the current quarter. According to Spiegel, the social media business would also reduce employment until the end of the year to save costs. The memo was filed officially with the SEC (Securities and Exchange Commission).

Spiegel has essentially told investors that sales growth will be less than planned. In his letter to SNAP employees, he noted that “Like many companies, we continue to face inflation, rising interest rates, supply chain shortages and labor disruptions, platform policy changes, the impact of the war in Ukraine, and more.”

What more did SNAP CEO indicate concerning its stock’s profitability, and what should investors take away from this?

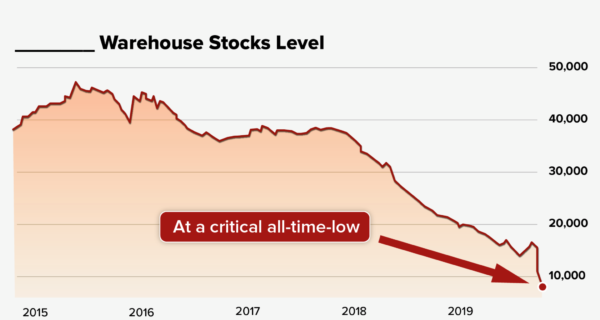

In his note to SNAP employees, CEO Evan Spiegel explained that the company anticipates revenues to fall short of the low end of projections for the current fiscal quarter. SNAP‘s stock price plummeted to a level it hasn’t seen since mid-2020. The less-than-optimistic news and the official SEC filing created some anxiety among investors and traders, leading to the drastic price drop. SNAP performed poorly both during Monday’s trading session and then more after-hours.

According to Spiegel’s e-mail to staff, SNAP will continue to recruit new employees but will limit hiring for the remainder of the year; Spiegel still expects Snap to hire 500 new employees before the end of the year. SNAP‘s pessimistic appraisal of the previous month resonates with social media users. Snapchat isn’t taking the loss on its own: After-hours, Meta Platforms (FB) was down 6.9%, Alphabet (GOOGL) was down 4.2% postmarket, Twitter (TWTR) fell by 4%, and Pinterest (PINS) is by 9.1%.

Also written in SNAP CEO Evan Spiegel’s note on Monday, “Today we filed an 8-K, sharing that the macro environment has deteriorated further and faster than we anticipated when we issued our quarterly guidance last month. As a result, while our revenue continues to grow year-over-year, it is growing more slowly than we expected.”

SNAP posted first-quarter profits in April that fell short of Wall Street’s sales and profit projections. The firm stated at the time that sales growth would be between 20% and 25% year-over-year. SNAP predicted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $0 to $50 million. In Spiegel’s Monday note, he also stated, “We believe it is now likely that we will report revenue and adjusted EBITDA below the low end of the guidance range we provided for this quarter.”

SNAP’s letter to employees from their CEO wasn’t meant to catastrophize or dwell on adverse market outcomes. Instead, Spiegel gave a concise statement, with some practical truths but also some decent assurances. His sentiment was that future revenue growth, together with the strength of its balance sheet, has well-positioned SNAP for the present climate. Foundations are solid, the community is expanding and engaged, and SNAP is looking forward to the numerous opportunities ahead. As a result, despite the current market turbulence, 2022 remains a crucial investment year for SNAP.

Spiegel also stressed that SNAP would be able to invest and grow as a company if it were to manage its spending responsibly throughout this time. Moving forward, SNAP will reprioritize investments and continue investing across its business goals, but at a slower, steadier rate than initially projected due to the current state of the economy. Let’s keep our fingers crossed for a brighter future for both SNAP and its shareholders.