Investor sentiment is pessimistic this morning to start the final trading session of the week with all major indices in the red. Market movement has been muted this week, and mostly to the downside. However, the Dow, the S&P 500 and the Nasdaq all remain less than 1% away from record highs.

2020’s top stocks typically were tied to companies that benefited from new and accelerated trends resulting from COVID-related lockdowns. However, many of the best stocks for 2021 are largely expected to benefit from a “return to normalcy” and a healing economy. Our trade alert for today highlights one such stock.

Stryker’s (SYK) medical devices range from implants used in joint replacements and spinal surgeries to surgical equipment and navigation systems. The company operates through three segments: Orthopedics, MedSurg, and Neurotechnology and Spine. The MedSurg segment offers surgical equipment and surgical navigation systems, endoscopic and communications systems, patient handling, among others.

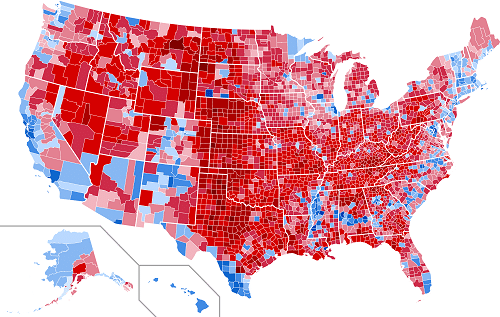

Robotic surgery has been rapidly gaining traction, owing to the precision that it offered. Notably, the global surgical robotics market is expected to witness a CAGR of about 21% during 2021 to 2026, per a report by Express Market Research. However, because of the pandemic, the usage of robots in other areas of healthcare also increased as they are being used to maintain social distancing while ensuring continued interaction between doctors and patients. Strong markets include the U.S., Australia, Germany, Canada, and especially China.

New-patient demand remains in question as long as COVID-19 infection rates remain high, but hospitals are adapting their infection-prevention protocols, and the rate of elective procedures has started to accelerate.

Analysts at Canaccord Genuity say Stryker should be a “core position for growth-oriented investors.”

The Zacks Consensus Estimate for its current-year earnings increased 2.9% over the past 90 days. The company’s expected earnings growth rate for the current year is 26.7%. Based on 18 analysts offering recommendations, 12 rate the stock a Strong Buy. There is 1 Moderate Buy rating, 4 Hold ratings, and 1 analyst rates the stock a Sell. Argus Research analysts rate SYK a Buy and see the stock hitting $265 per share over the next 12 months.

Where to invest $1,000 right now...

Before you consider buying Stryker, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Stryker.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...