This week has been a rollercoaster. Many factors that could steer the market in either direction remain unresolved. Pandemic resurgence fears are looming. The presidential election is just one month away and yesterday the president reported he himself tested positive for covid-19. There is yet to be resolution on stimulus.

Our research team recently pointed out some significant investing ideas to help grow and protect your wealth, despite overwhelming uncertainty. Here are some of those trade ideas that may serve you as you navigate the current situation.

Abbott Laboratories (ABT)

With cases rising in 26 U.S. states, experts warn that the U.S. is not out of the woods yet and that the pandemic could worsen in the fall. Johns Hopkins School of Medicine epidemiologist Eli Klein told the Washington Post earlier this month, “My feeling is that there is a second wave coming, and it’s not so much whether it’s coming but how big it’s going to be.”

A second wave would almost certainly spur an increase in demand for Abbott Laboratories (ABT) COVID-19 diagnostic tests. Abbott markets six COVID-19 tests under the FDA’s emergency use authorization program.

Even if the pandemic doesn’t worsen, ABT could be a great stock to own. The company claims multiple growth drivers other than its COVID-19 test. What’s more, Abbott is a Dividend Aristocrat with 48 consecutive years of dividend increases.

British American Tobacco (BTI)

BTI share price is down roughly 10% over the past three months amidst a slide for the entire industry. But the company’s financial’s over the long term look respectable enough to suggest that in this case, the baby may have gotten thrown out with the bathwater.

The company’s ROE is predicted to rise 12% over the next three years. Return on equity for BTI is currently 9.4%. Furthermore, BTI has paid dividends for at least ten years which means the company is serious about sharing profits with its shareholders. Currently BTI pays a nice 9.31% dividend yield.

Conventional tobacco will likely continue to drive the profits and the cash flow needed to support BTI’s dividend yield for at least the next ten years. However, tobacco companies know the long-term future hinges on electronic cigarettes and other next-generation products. British American may be the best-positioned tobacco company in emerging categories, given its Vype brand and Vuse investment.

Chevron (CVX)

CVX share price is down more than 40% for the year. Some analysts say CVX stock has moved back to a price where risk/reward is attractive. Considering the resilience of energy demand and the existing possibilities for merger activity if key stocks stay low, investors with longer-term time horizons might want to consider CVX at these levels.

Keep in mind, a significantly bullish turn may not come for CVX until the hefty oil-inventory surplus shrinks. U.S. petroleum stocks totaled 1.4 billion barrels in the week ending Sept. 18, according to the Energy Information administration. Oil demand is not expected to return to pre-pandemic levels until at least year’s end. But with Chevron’s recent purchase of oil driller Noble Energy, which has both U.S. and international operations, CVX is primed for expansion. Not to mention the 7.17% dividend yield CVX investors enjoy.

United Rentals Inc. (URI)

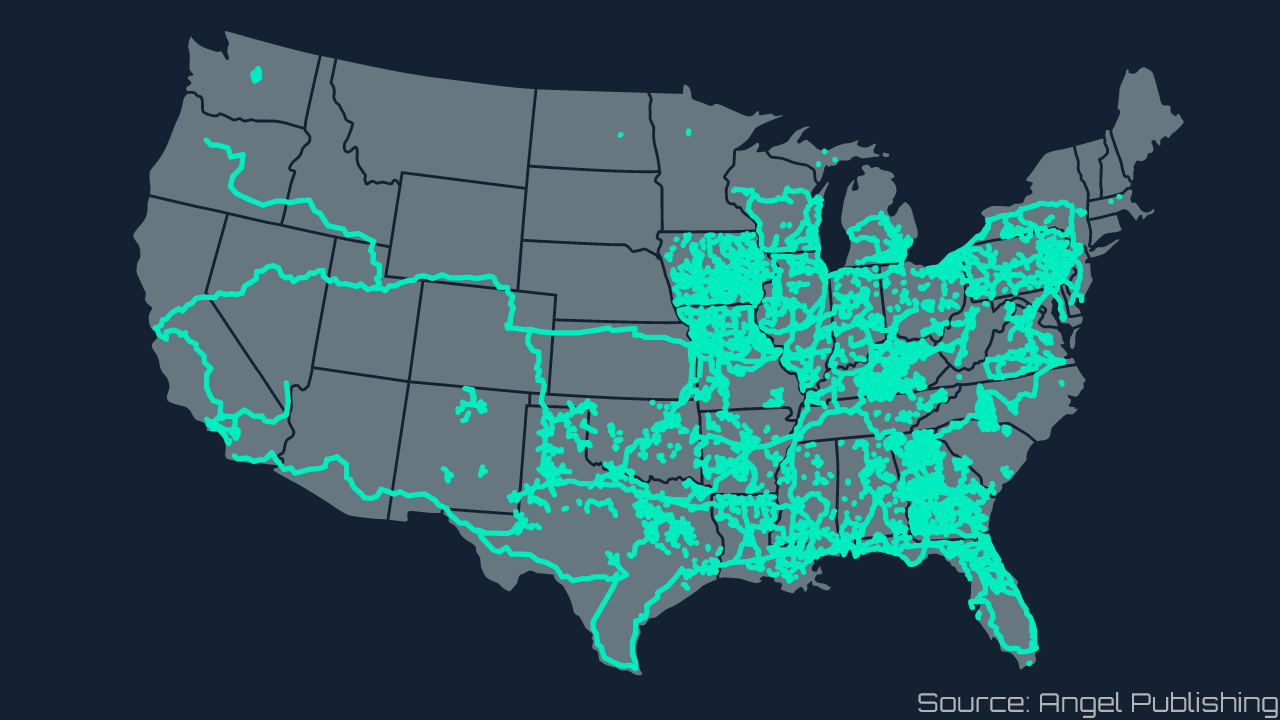

Both Trump and Biden are likely to funnel more money into infrastructure spending. Construction projects like 5G cell towers and roads and bridges would get Americans back to work. Infrastructure companies can navigate the volatility, keep doing their business, and come out on the other side stronger. One stock that stands to benefit greatly from more infrastructure spending is United Rentals Inc. (URI).

United Rentals Inc. is an equipment rental company with a network of locations throughout the U.S. and Canada. The company offers rentals to businesses in the construction industry, industrial commercial firms, as well as homeowners and other individuals.

The company reported a 21.5% decline in net income as revenue fell 15.3% in Q2, due to the slowdown in economic activity stemming from the COVID-19 pandemic.

Short term volatility is certainly to be expected for industrials, but many analysts are shifting focus to the sector which has significantly lagged the broader market. The Industrial Select Sector SPDR ETF (XLI) has provided a total return of 8.6% over the last 12 months. Paltry compared to the S&P 500’s total, 12-month return of 23%. Which means there may be plenty of runway ahead for industrials and for URI, no matter who wins the election.