Seeking out great stocks to buy is essential, but many would say it’s even more important to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, figuring out which stocks to trim or get rid of is essential for proper portfolio maintenance.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Continue reading to find out which three stocks our team is staying away from this week.

The announcement of a poorly timed CEO transition followed by dismal FY21 preliminary figures put biomedical instrument developer Berkeley Lights (BLI) at the top of our list this week.

It was revealed that Berkeley Lights is initiating a search for a new CEO as current CEO Eric Hobbs, Ph.D., will transition from his role as chief executive officer and member of the board of directors to the president of the Antibody Therapeutics business line. William Blair Analyst Brian Weinstein called the transition “unconventional” when he downgraded BLI to Market Perform from Outperform on Thursday. The announcement came in tandem with a peek into a less productive 2021 that Wall Street expects.

We’ll get a look at BLI’s full financial results for the fourth quarter and full-year 2021 in late February, but results based on management’s initial analysis are pointing to a steep revenue miss. The pros are looking for $90.85M in revenue for the full year. By Berkeley Lights preliminary calculations, the company expects just $84M-$84.5M in 2021 revenue. If that’s not bad enough, the company adjusted 2022 guidance below the consensus expectations. Stifel analyst Daniel Arias put it best – BLI “seems bound to be dead money for a while.” We’ll keep our distance pending further developments.

TripAdvisor’s (TRIP) makes our stocks to avoid list again, as their voyage downward continues. Since mid-March, TRIP stock price has been stumbling downward and doesn’t seem likely to make the return trip anytime soon. Especially not after major hotel chains joined forces last month to force TripAdvisor to reverse course on its subscription to a cash-back instead of hotel discounts, seemingly taking the wind out of the company’s Tripadvisor Plus program.

“This shift is a big departure for Tripadvisor, having previously pushed Tripadvisor Plus as offering ‘no brainers’ to customers and enticing them with best in class rates,” said Bernstein analyst Richard Clarke. “The new model makes sense and could offer good deals to customers, but will be in a competitive space with Booking.com, Hopper and Revolut also offering cash back/credit on bookings with also charging a $99 fee. This might ultimately be a test if Tripadvisor Plus can be a full-service travel subscription offer, not just a discount club.”

Mizuho analyst James Lee lowered the firm’s price target on TripAdvisor to $42 from $50, citing the disruption in travel trends in Q3 by new delta cases, which caused travel restrictions and consumer hesitancy heading into the holidays. The analyst believes the travel recovery story has been pushed back to mid-2022. With omicron developments, that timeline could be further extended.

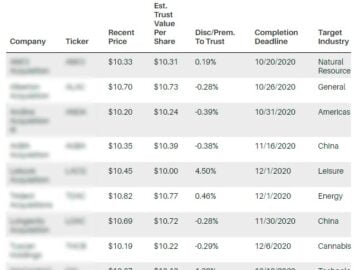

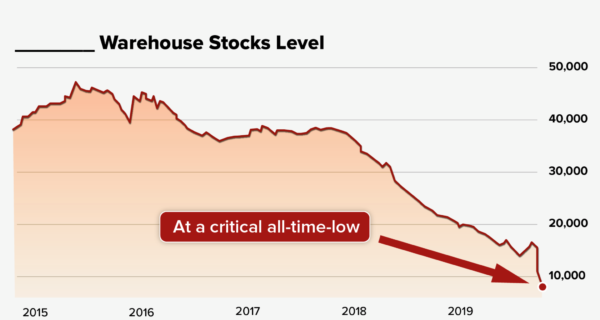

Finally, global supply constraints continue to drag Bed Bath & Beyond (BBBY) sales lower, while inventory replenishment delays are expected to continue into 2022. Last week, it was reported that BBBY was unable to meet demand in Q3, leading to misses on the top and bottom lines. Management estimates missing out on $100M of sales for the quarter and admits that the company’s turnaround is taking longer than anticipated.

Mark Tritton, Bed Bath & Beyond’s President and CEO, said, “During a quarter where our sales momentum was not where we wanted it to be with sales of $1.9 billion, and a 7% comp decline, improved momentum in November and strong gross margins demonstrated progress in our transformation. After our previously announced slower start to sales in September and October, we drove a change in trends by November, with our comp decline improving, particularly in stores. However, overall sales were pressured despite customer demand due to the lack of availability with replenishment inventory and supply chain stresses that had an estimated $100 million, or mid-single-digit, impact on the quarter and an even higher impact in December.”

As a reflection of the continued impact of anticipated global supply chain challenges, the company lowered its Q4 guidance. BBBY now expects EPS of 0c-15c and Q4 revenue of $2.1B. The revelation sent waves through the analyst community, where revenue of $2.27B and 72c EPS is expected for the fourth quarter.

Loop Capital analyst Anthony Chukumba lowered the firm’s price target on BBBY to $10 from $14 and kept a Sell rating on the shares. The analyst tells investors in a research note that the company’s Q3 went “from bad to worse” with “substantial” misses on revenue, profitability, and earnings. Chukumba adds that he continues to believe that Bed Bath’s struggles are mainly due to the fact that the company has lost market share and consumer relevance, neither of which will be “easy to regain.”

We’re sticking to the sidelines while the company pursues additional expense optimization measures.