Stocks changed course late in the week last week to finish lower following the Fed’s decision to ramp down pandemic-era bond purchases at a quicker pace than planned. The announcement came amid rising infection rates, causing companies to reevaluate their 2022 outlooks. The S&P 500, Dow, and Nasdaq were all down for the week, with the Nasdaq leading the decline.

Investors can expect releases on durable goods orders, home sales, and personal consumption expenditures (PCE) for November in the week to come. The so-called PCE deflator is the Federal Reserve’s most-watched inflation metric and will come hot on the heels of November’s red hot consumer price index (CPI), reading up 6.8% on a year-over-year basis, the fastest increase since June 1982. Investors will be tuned in for Thursday’s PCE reading.

Volatility in the holiday-shortened week ahead seems likely as thin volume could exaggerate moves in both directions. Markets in the U.S. and worldwide will be closed Friday in observance of Christmas Eve.

“As we head into the last two weeks of the year, we know volume is light and volatility can also pick up,” said Jeff Kleintop, chief global investment strategist at Charles Schwab. “There’s the possibility of a Santa rally, but there’s also the possibility that the lack of volume can lead to dramatic swings to the downside as well.”

Our team has a few recommendations of stocks to watch as we round the corner into the new year.

First up on our weekly watchlist, Medical Properties Trust (MPW) is a healthcare REIT that invests in hospitals; it owns 385 hospital properties representing 42,000 licensed beds across nine countries. Medical Properties Trust leases facilities to 46 hospital systems and ranks as the second-largest owner of hospital beds in the U.S. Hospital systems enter into sale-leaseback arrangements with the REIT to monetize real estate assets and reduce operating costs.

MPW has delivered 30% annual asset growth and 8% annual FFO per share gains over the past decade. That has helped a short string of seven consecutive years of dividend increases, with growth averaging a modest 4% annually.

During the first nine months of 2021, Medical Properties Trust grew FFO per share by 15%. It closed $3.1 billion of acquisitions, with more deals scheduled to close in 2022 as the REIT capitalizes on acquisition opportunities created by the pandemic.

“Management’s strong capital allocation acumen, along with deep operator relationships, should generate strong earnings, NAV, and dividend growth for shareholders for the foreseeable future,” contends Raymond James analyst Jonathan Hughes who recently initiated coverage of Medical Properties Trust with a Strong Buy rating and $25 price target.

Next up is CVS Health Corporation (CVS). The company recently outlined its long-term growth strategy at its 2021 Investor Day, aiming at capitalizing on the significant market opportunity to make healthcare more convenient, personalized, and affordable for consumers. The company will optimize the retail portfolio to serve as community health destinations by closing nearly 900 stores over the next three years to reduce store density and ensure it has the right kinds of stores in the right locations for consumers and the business.

Moreover, CVS Health is driving a digital-first, technology-forward approach that will expand its reach and engagement with its more than 35 million online members. The company will also enhance omnichannel health services to meet the needs of consumers as and when required.

For 2021, the company projects total revenues of at least $290.30 billion. The company’s adjusted earnings per share (EPS) is expected to be at least $8.00. Cash flow from operations is expected to be at least $13.50 billion.

CVS Health also presented a long-term outlook and growth targets. As part of its long-term growth trajectory, the company targets a return to low double-digit adjusted EPS growth in 2024 and beyond.

Goldman Sachs analyst Nathan Rich recently initiated coverage of CVS with a Buy rating and $121 price target. The analyst started the U.S. Managed Care sector with a positive outlook and sees potential for 13% annual earnings growth for the large-cap names over the next two years. He sees “under-appreciated optionality” in CVS’s new provider-focused strategy, with leverage to the value-based care theme and “strong” underlying fundamentals.

Given the sluggish backdrop for high-priced tech stocks, bearish investors may want to go near-term short on the Nasdaq- 100 Index. First up on our weekly watchlist is an ETF that allows just that. The ProShares Short QQQ (PSQ) fund offers inverse exposure to an index comprised of the 100 largest nonfinancial securities on the NASDAQ, making it a potentially attractive option for investors looking to bet against this sector of the U.S. economy.

It’s important to note that PSQ is designed to deliver inverse results over a single trading session, with exposure resetting on a monthly basis. Investors considering this ETF should understand how that nuance impacts the risk/return profile and realize the potential for “return erosion” in volatile markets. PSQ should not be found in a long-term, buy-and-hold portfolio but may be a valuable tool for more active investors looking to hedge existing exposure or bet on a decline in the top nonfinancial NASDAQ securities.

ProShares Short QQQ (PSQ) Data Summary

- Net Assets 576.04M

- Expense Ratio 0.95%

- Average Daily Volume $60.72M

Should you invest in CVS right now?

Before you consider buying CVS, you'll want to see this.

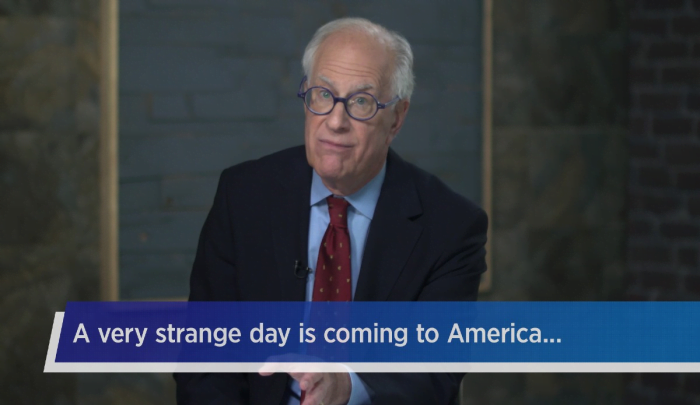

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not CVS.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...