You can download an up-to-date list covering all of the dividend stocks owned by Warren Buffett by clicking here.

While Berkshire Hathaway itself does not pay a dividend because it prefers to reinvest all of its earnings for growth, Warren Buffett has certainly not been shy about owning shares of dividend-paying stocks. We will analyze each of Buffett’s dividend stocks in this article.

A dividend is often the sign of a financially healthy and stable business that is committed to rewarding shareholders. These are some of the qualities Warren Buffett looks for when he invests.

Berkshire Hathaway Portfolio Update

Notable Additions

Berkshire invested over $500 billion during the third quarter, picking up new positions in Restoration Hardware (RH) and Occidental Petroleum (OXY). The firm didn’t add to any of its existing positions, though.

Restoration Hardware doesn’t pay a dividend but is a disruptor in the luxury home furnishings market. The company embraces a membership model rather than running promotions, maintains elaborate showrooms, and believes it can compound its earnings 15% to 20% annually for the next 10 years.

Warren Buffett’s involvement in the furniture industry spans decades, including his 1983 purchase of a majority ownership stake in Nebraska Furniture Mart. He likely sees potential in Restoration Hardware’s unique retail strategy and believes the business has developed an enduring brand that will fuel profitable long-term growth for longer than the market is pricing in.

Buffett’s $330 million investment in Oxy’s common shares is relatively small compared to the $10 billion investment he made in the energy giant’s preferred stock in April 2019.

Investors have hammered Oxy’s shares due to concerns about the company’s pricey takeover of Anadarko, as well as the weak energy environment. Buffett seems to be a believer in U.S. shale and the price of oil improving in the long term.

Notable Reductions

Similarly, Buffett sold some more shares of Wells Fargo (-7%) but only to keep Berkshire’s position below the 10% ownership threshold allowed by regulators.

Finally, the firm continued trimming back its position in Phillips 66 (-6%), which represents just 0.25% of Buffett’s stock portfolio. Berkshire began reducing this investment in 2018 due to regulatory requirements that came with ownership levels above 10%.

However, it appears Buffett may be exiting Phillips 66 and the refinery space as he puts more focus on his new energy bet, Oxy. Refining margins typically benefit from a low price of oil, while shale producers like Oxy get hurt. Buffett’s shift in the energy space suggests he may believe oil prices are likely to head higher from here, and the market is not reflecting that likelihood in Oxy’s price.

Warren Buffett’s Investment Strategy

Warren Buffett’s portfolio remains concentrated today, and his three largest positions each account for over 10% of Berkshire Hathaway’s portfolio. The idea behind running a concentrated portfolio is that there are relatively few excellent businesses and investment opportunities in the market at any given time, and owning too many positions reduces the impact from your few best ideas.

Importantly, Warren Buffett’s investment strategy has always been focused on the concept of staying within one’s circle of competence. Buffett has said that “risk comes from not knowing what you’re doing.”

In other words, never invest in a business or industry that is too hard for you to understand. The reality is, most investment opportunities fall outside of our circle of competence and should be ignored.

Since the days of his initial partnership, Buffett’s strategy has evolved to concentrate more on buying up wonderful businesses at reasonable prices rather than digging through the bargain bin for “cheap” stocks. He looks for companies that have strong economic moats and numerous opportunities for growth.

Analyzing Warren Buffett’s Top High-Yield Dividend Stocks

1: Occidental Petroleum (OXY)

Percent of Warren Buffett’s Portfolio: 0.2%

Dividend Yield: 8.1% Forward P/E Ratio: 36.0x (as of 11/18/19)

Sector: Energy Industry: Integrated Oil and Gas

Dividend Growth Streak: 16 years

Many Oxy investors felt the company paid a steep price for this controversial purchase, further exacerbated by the costly preferred stock issued to Berkshire. In the third quarter of 2019 Buffett increased his involvement with Oxy, buying about 1% of the firm’s common stock.

Following its acquisition of Anadarko, Oxy is one of the largest oil & gas producers in America, with leading positions across key shale basins. As Warren Buffett has said, owning Oxy is essentially a bet on the price of oil and the long-term growth of the Permian basin.

Oxy’s cash flow is very sensitive to the price of oil, and the company is saddled with debt following its Anadarko deal. As a result, the stock will likely remain highly volatile until the firm’s balance sheet strengthens and the price of oil improves.

2: Kraft Heinz (KHC)

Percent of Warren Buffett’s Portfolio: 4.2%

Dividend Yield: 5.1% Forward P/E Ratio: 12.0x (as of 11/18/19)

Sector: Consumer Staples Industry: Miscellaneous Food

Dividend Growth Streak: 0 years

Kraft and Heinz have operated in the food industry for over 100 years and collectively own famous brands such as Jell-O, Velveeta, Lunchables, Bagel Bites, Philadelphia, Ore Ida, Planters, Oscar Mayer, and many others.

“The short term doesn’t make much difference to us, because we will be in this stock forever. This is a business with us. It’s not really a stock…It’s where the new Kraft Heinz Co. is 10, 20, 50 years from now that counts to Berkshire. These are brands I liked 30-plus years ago, and I like them today. And I think I’ll like them 30 years from now.”

While KHC seemed like another Buffett stock that could be boring and predictable for long-term income investors, several of Kraft Heinz’s major brands struggled to adapt their portfolios to the healthier eating trend.

The firm’s struggles came to a head in February 2019, when management decided to cut Kraft Heinz’s dividend to accelerate deleveraging efforts.

As Warren Buffett summarized in an interview with CNBC, he “was wrong in a couple of ways about Kraft Heinz” and ultimately overpaid for the business as its pricing power deteriorated unexpectedly:

“When you’re going toe to toe with a Walmart or a Costco or maybe an Amazon pretty soon…you’ve got the weaker bargaining hand than you did 10 years ago…

Costco introduced the Kirkland brand in 1992, 27 years ago, and that brand did $39 billion last year whereas all the Kraft and Heinz brands did $27, $26 or $27 billion.

So here they are, a hundred years plus, tons of advertising, built into people’s habits and everything else, and now Kirkland, a private label brand, comes along and with only 750 or so outlets does 50% more business than all the Kraft-Heinz brands.

So house brands, private label, is getting stronger. It varies by country around the world, but it’s bigger. And it’s gonna keep getting bigger.”

Read More: Our Analysis of Kraft Heinz

3: General Motors (GM)

Dividend Yield: 4.2% Forward P/E Ratio: 7.4x (as of 11/18/19)

Sector: Consumer Discretionary Industry: Domestic Auto Manufacturers

Dividend Growth Streak: 0 years

General Motors is one of biggest manufacturers of cars and trucks in the world. Most of the company’s sales are pickup trucks and crossovers, which carry higher margins than passenger cars.

However, the “new” GM is much stronger than its predecessor and has substantially improved its earnings power and financial health, which management hopes will allow the company to continue paying its dividend during the new industry downturn.

Buffett’s favorite holding period is “forever,” and he probably sees plenty of room for General Motors to continue growing its earnings over time as it continues cutting costs and making investments in higher-margin areas.

While the auto industry is certainly cyclical, GM appears well positioned to get through almost any environment and remain relevant for a long time to come.

4: Suncor (SU)

Percent of Warren Buffett’s Portfolio: 0.2%

Dividend Yield: 4.0% Forward P/E Ratio: 14.6x (as of 11/18/19)

Sector: Energy Industry: Integrated Oil & Gas

Dividend Growth Streak: 16 years

SU is an integrated energy company focused on developing Canada’s oil sands. Oil sands is a mixture of bitumen, sand, fine clays, silts, and water. Because it does not flow like conventional crude oil, it must be mined or heated underground before it can be processed.

In addition to its upstream exploration and production activities, the firm generates a substantial amount of its profits from midstream and downstream (refining & marketing) operations, which include a handful of refineries, lubricants and ethanol plants, and Petro-Canada retail gasoline stations. This integrated portfolio helps provide solid profits even when the price of oil is weak.

However, during the fourth quarter of 2018, Suncor’s stock price plunged to its lowest level since 2016. Berkshire pounced on the opportunity to get back into a business it knows very well at a price it liked.

Suncor is one of the most conservatively managed energy producers, but only time will tell if Berkshire is making a long-term commitment here or simply saw an opportunity to capitalize on overly pessimistic investors pushing SU’s valuation too low.

5: Wells Fargo (WFC)

Dividend Yield: 3.8% Forward P/E Ratio: 12.5x (as of 11/18/19)

Sector: Financials Industry: Major Regional Banks

Dividend Growth Streak: 9 years

Overall revenue is split almost equally between traditional loan-making operations and noninterest income from brokerage advisory services, credit card fees, commissions, mortgage originations, and more.

Banking can be a disastrous business to invest in if reckless loans are issued, so the company’s management and culture are extremely important factors. In the case of Wells Fargo, it was historically thought to be one of the highest quality and most conservatively managed banks.

Buffett also probably likes Wells Fargo for the long haul because it possesses major cost advantages over its smaller peers. The bank has more retail deposits than any other bank in America and has seen its total deposits grow from $3.7 billion in 1966 to $1.3 trillion as of the end of 2018.

As the U.S. economy continues expanding, Wells Fargo should be able to mint money with its loan book and continue earnings superior returns on equity relative to its peers.

Specifically, he commented that most of Berkshire’s best investments (American Express, Geico) were in firms that fell into trouble due to poor incentive systems that caused short-term problems. All big banks have had troubles, but he sees no reason why Wells Fargo would be inferior to other banks from investment and moral standpoints going forward.

Buffett and Munger like how the firm is correcting the bank’s mistakes and see no reason why Wells Fargo will be anything other than a large well-run bank that comes out stronger from this. Munger even suggested that Wells Fargo might be the bank that is most likely to behave the best in the future as a result of faulty incentive system coming to light.

6: STORE Capital (STOR)

Percent of Warren Buffett’s Portfolio: 0.3%

Dividend Yield: 3.5% Forward P/AFFO Ratio: 19.7x (as of 11/18/19)

Sector: Real Estate Industry: Retail REIT

Dividend Growth Streak: 5 years

STORE Capital is a real estate investment trust that Berkshire Hathaway acquired an initial stake in during the second quarter of 2017. While the company only accounts for about 0.3% of Buffett’s portfolio, Berkshire owns approximately 8.7% of the firm’s shares.

STORE is a net-lease REIT that primarily owns single tenant, retail-focused properties. Service assets (e.g. early childhood education, health clubs, pet care, movie theaters) account for 65% of its rental income, followed by retail (e.g. furniture stores, home goods, outdoor outfitters, hobby centers) at 18% and manufacturing (e.g. playground equipment, medical devices, aerospace components) at 17%.

STORE Capital has more than 400 customers (top 10 are less than 20% of total rent) and over 2,200 investment property locations across 48 states. STORE’s property investments total more than $6 billion, and management believes the market for its properties exceeds $2.6 trillion in value (more than 1.6 million properties), providing ample room for growth.

STORE Capital’s stock fell 35% from July 21016 through May 2017 as sentiment soured on virtually all retail-related businesses. Buffett’s shares were also acquired in a private placement deal, which allowed him to buy the stock at a discount to its price at the time (and actually below its 52-week low).

7: Phillips 66 (PSX)

Dividend Yield: 3.1% Forward P/E Ratio: 10.9x (as of 11/18/19)

Sector: Energy Industry: Oil Refining & Marketing

Dividend Growth Streak: 7 years

Phillips 66 was spun off from ConocoPhillips in 2012 and generates the majority of its profits from refining oil, marketing refined petroleum products such as gasoline, and selling various chemicals such as plastics that are made from oil.

Management is investing in midstream and chemicals operations to drive future growth, which will make the business less dependent on refining and provide more balanced cash flows.

However, Berkshire continues exiting its stake in Phillips 66 while making a substantial investment in Oxy. Buffett may believe oil and gas producers provide better value in today’s volatile energy environment.

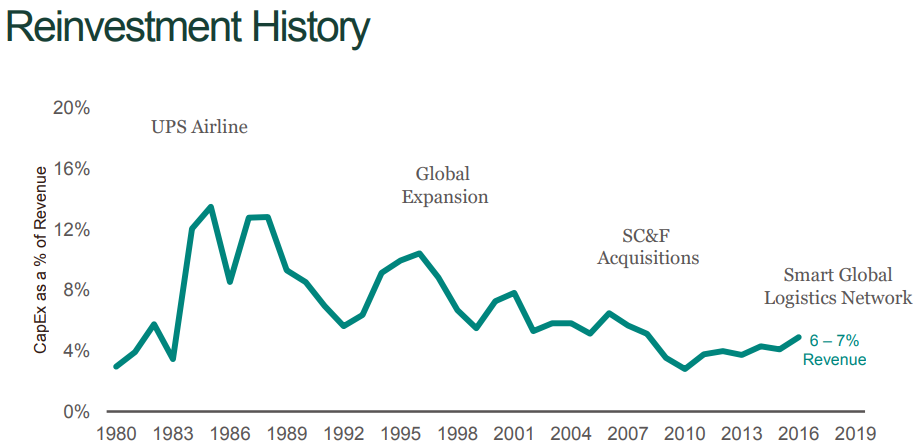

8: United Parcel Service (UPS)

Dividend Yield: 3.1% Forward P/E Ratio: 15.5x (as of 11/18/19)

Sector: Industrials Industry: Air Freight Transport

Dividend Growth Streak: 10 years

United Parcel Services was founded in 1907 and has grown to become the largest package delivery company in the world. In fact, UPS delivers 20 million packages and documents each day to around 10 million customers located in more than 220 countries and territories.

Warren Buffett has owned United Parcel Services since 2007, although it has remained a very small part of Berkshire Hathaway’s portfolio.

9: Coca-Cola (KO)

Dividend Yield: 3.0% Forward P/E Ratio: 24.0x (as of 11/18/19)

Sector: Consumer Staples Industry: Soft Drinks

Dividend Growth Streak: 57 years

Coca-Cola might be Warren Buffett’s most famous stock investment. Buffett scooped up a major stake in Coca-Cola in 1988 after the 1987 stock market crash made the company’s valuation too enticing to pass up.

Coca-Cola’s strong brands and extensive distribution system around the world have enabled it to become the number one provider of sparkling and still beverages and increase its dividend for over 50 straight years, qualifying the company as a member of the dividend kings list.

10: Restaurant Brands (QSR)

Percent of Warren Buffett’s Portfolio: 0.3%

Dividend Yield: 3.0% Forward P/E Ratio: 23.2x (as of 11/18/19)

Sector: Consumer Discretionary Industry: Food & Restaurants

Dividend Growth Streak: 5 years

Restaurant Brands International is the parent company of Burger King and Tim Hortons, which combined in 2014 to claim the title of the world’s third-largest fast food business with over 20,000 restaurants.

Tim Hortons was founded in 1964 and is the largest quick service restaurant chain in Canada. The restaurant specializes in coffee, baked goods (e.g. doughnuts), and home-style lunches.

Berkshire Hathaway also owns $3 billion of preferred shares in the company, which pay him a high-yield dividend of 9% each year.

The consumer sector is home to many famous brands and has historically been one of Warren Buffett’s favorite places to pick stocks.

Burger King and Tim Hortons are two of the most well-known restaurant brands in the United States and Canada.

Importantly, both businesses seem to have plenty of potential for international growth. Burger King is already in more than 100 different countries, and Tim Hortons has little presence outside of Canada.

The company’s global scale, brand recognition, and prominent locations make it a free cash flow machine that should enjoy steady growth over the long term.

11: PNC Financial Services (PNC)

Dividend Yield: 3.0% Forward P/E Ratio: 13.1x (as of 11/18/19)

Sector: Financials Industry: Regional Banks

Dividend Growth Streak: 9 years

Incorporated in 1983, PNC is a large regional bank with operations in nearly 20 states and more than 2,000 branches. The firm provides a mix of retail and commercial banking, mortgage lending, and asset management services (including a 22% minority ownership stake in BlackRock). Net interest income makes up a little over half of PNC’s net revenue, with noninterest income accounting for the remainder.

Since PNC is not one of America’s mega banks, it does not enjoy meaningful cost advantages compared to its larger peers (PNC’s efficiency ratio sits near 60%). However, its relatively smaller size does mean it is not subject to as stringent of capital requirements and can more easily grow.

PNC likely appealed to Berkshire Hathaway because of its conservatism. The bank outperformed its peers during the financial crisis (lower charge-offs), a testament to its disciplined underwriting culture, and today PNC maintains a reasonable loan to deposit ratio of 85%.

PNC is adapting its business model for the future as well, using money from its continuous cost savings programs to invest in digital technology efforts. Berkshire Hathaway owns a mix of mega banks and smaller regionals, but they are all disciplined operators.

PNC is no exception and seems likely to continue growing its presence across the country.

12: U.S. Bancorp (USB)

Percent of Warren Buffett’s Portfolio: 3.4%

Dividend Yield: 2.8% Forward P/E Ratio: 13.6x (as of 11/18/19)

Sector: Financials Industry: Major Regional Banks

Dividend Growth Streak: 9 years

By business line, U.S. Bancorp generates 32% of its net income from consumer and small business banking, 21% from payment services, 23% from wholesale banking and commercial real estate, 13% from treasury and corporate support, and 11% from wealth management and securities services.

Overall, fee income accounted for 42% of total revenue in 2018. The company’s diversification makes it a more consistent and predictable business.

U.S. Bancorp has been one of Warren Buffett’s stock picks since before the financial crisis when he initiated a position in early 2007.

The company has a strong history of making high quality loans and remaining well capitalized relative to peers. As a matter of fact, U.S. Bancorp is the highest rated peer bank across all rating agencies when it comes to debt, providing it with funding and competitive advantages.

If Buffett owns the stock, it is safe to assume that USB’s culture is a conservative one that manages risk very carefully. This discipline shows up in USB’s profitability and efficiency metrics, which rank better than its peers.

Bank stocks look relatively cheap today because interest rates are expected to remain lower for longer. When rates are low, banks make less money on their lending operations.

Despite the tough environment for banks, USB’s loan portfolio has been growing at an annualized rate near 7% over the last decade.

The company’s loan book is also well-diversified and maintains little exposure to volatile energy markets (less than 2% of total exposure). U.S. Bancorp also has an A+ credit rating from S&P.

Warren Buffett owns U.S. Bancorp because it is a high quality, conservatively managed business that has demonstrated an ability to achieve consistent growth. Over time, these types of companies should compound shareholders’ capital nicely.

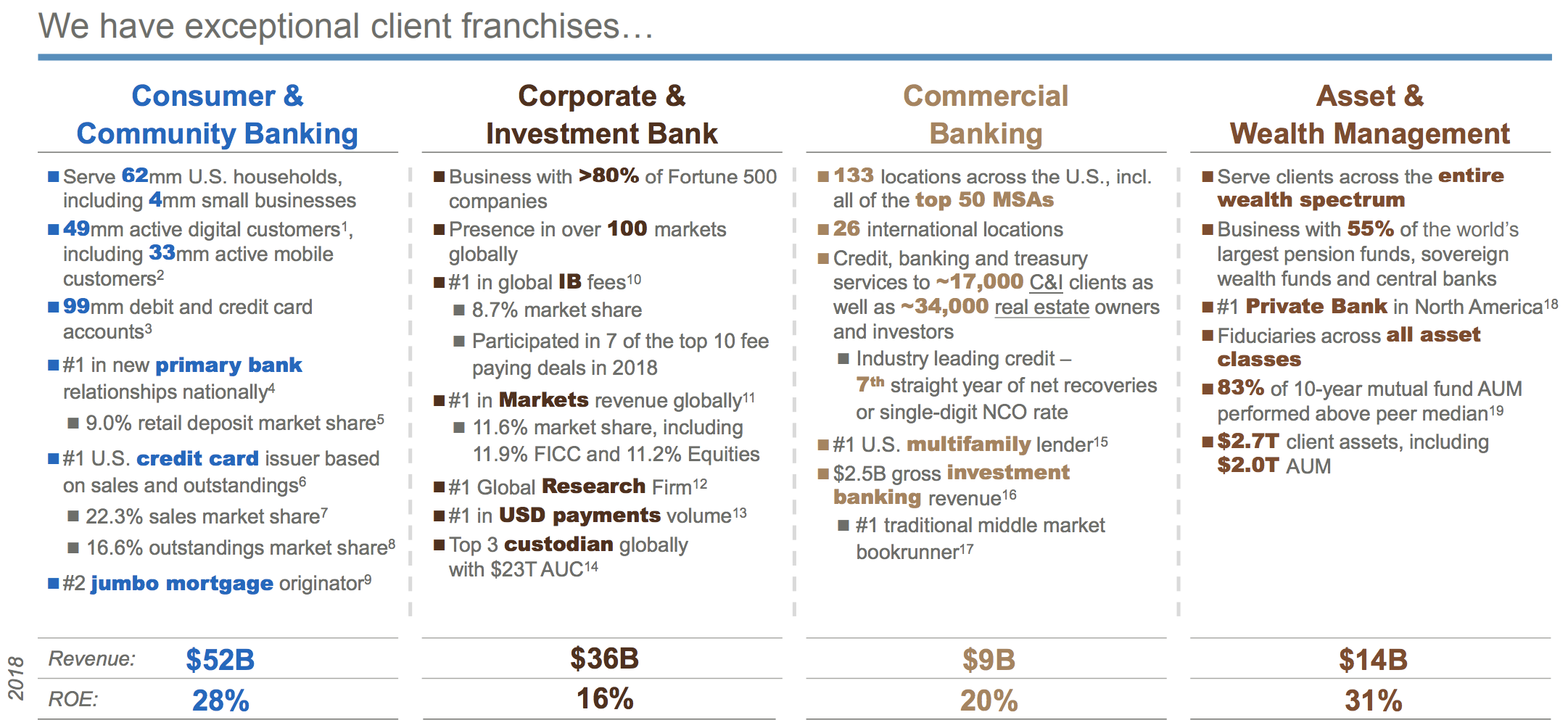

13: JPMorgan Chase (JPM)

Dividend Yield: 2.8% Forward P/E Ratio: 12.6x (as of 11/18/19)

Sector: Financials Industry: Diversified Banks

Dividend Growth Streak: 9 years

Berkshire Hathaway initiated a position in JPMorgan Chase during the third quarter of 2018, but the firm’s ties with the mega bank go further back.

In 2012, Buffett stated he has a personal stake in the bank. And in September 2016, Todd Combs, Warren Buffett’s possible successor, was named to JPMorgan’s board of directors.

As the largest bank in America, JPMorgan’s scale and dominance are impressive:

- Relationships with 50% of U.S. households

- Does business with over 80% of Fortune 500 companies

- #1 U.S. credit card issuer

- #1 in North America and EMEA in investment banking fees

- More than 5,000 branch locations

Thanks to its large size, diversification, and massive base of low-cost deposits ($1.4 trillion, of which about 30% have no interest cost), JPMorgan is a very efficient and profitable bank that is able to make money in practically any environment. Impressively, due to the bank’s status as a low-cost producer, management also targets a return on tangible equity of 17%.

CEO Jamie Dimon runs JPMorgan very conservatively as well. The bank’s capital reserve profile is even more conservative than the levels mandated by the Federal Reserve to help keep banks solvent during a severe global economic downturn, for example.

With bank stocks struggling throughout most of 2018 and early 2019, Berkshire Hathaway saw an opportunity to finally buy into one of the most impressive financial companies on Wall Street.

Read More: Our Analysis of JPMorgan Chase

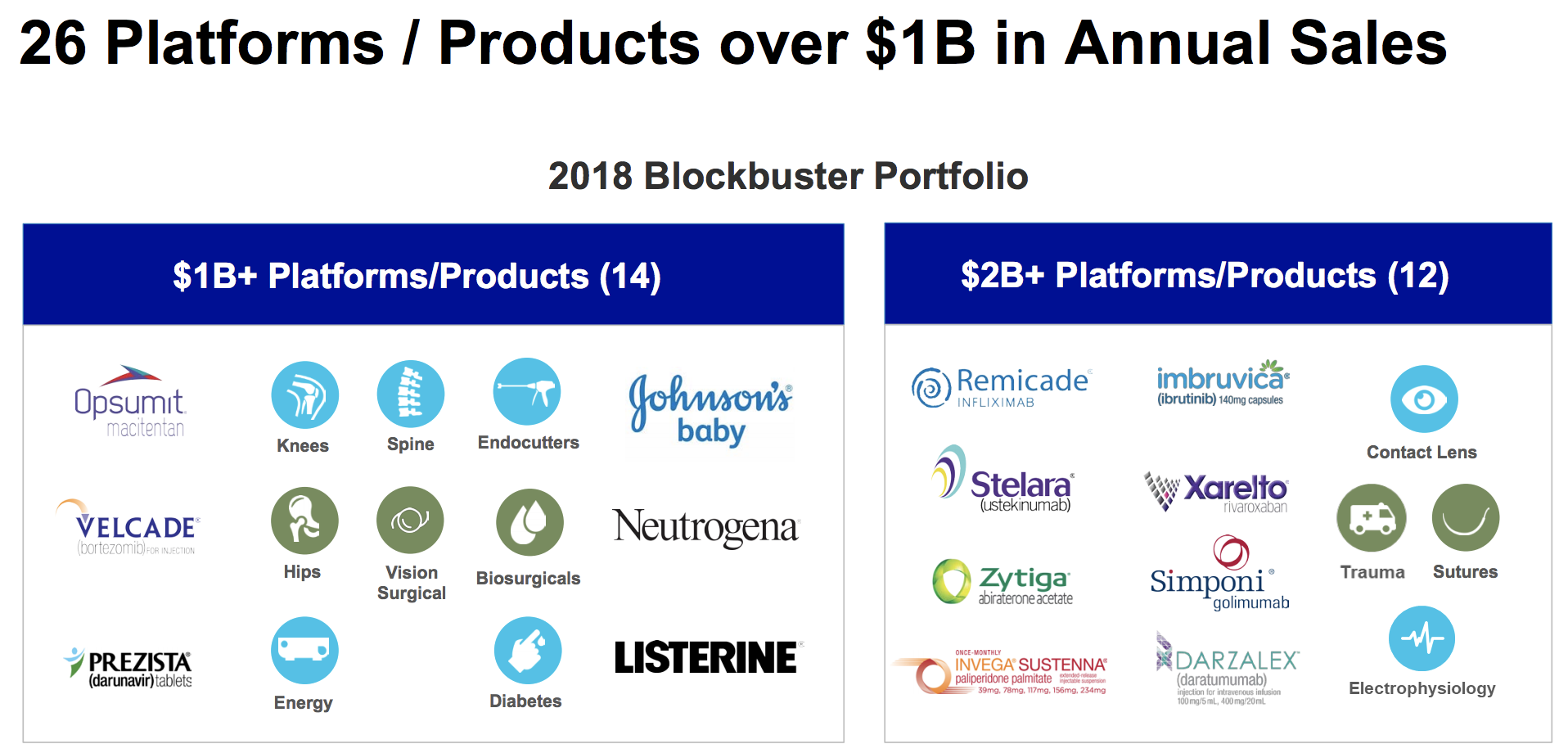

14: Johnson & Johnson (JNJ)

Percent of Warren Buffett’s Portfolio: 0.02%

Dividend Yield: 2.8% Forward P/E Ratio: 15.6x (as of 11/18/19)

Sector: Medical Industry: Pharma

Dividend Growth Streak: 57 years

Johnson & Johnson is one of the biggest healthcare companies in the world with over $80 billion in sales. Most of J&J’s profits are from sales of branded pharmaceuticals, but the company also has big consumer products and medical devices businesses.

Johnson & Johnson used to be one of Buffett’s biggest holdings 10 years ago but is one of Berkshire Hathaway’s smallest holdings today.

Why did Warren Buffett invest in Johnson & Johnson in the first place? For one thing, healthcare is one of the best stock sectors for dividends because of its stability.

People require healthcare products and services regardless of how the economy is doing, which makes Johnson & Johnson’s cash flows very reliable. The company’s sales were only down in the low-single digits during the financial crisis, and JNJ’s stock beat the S&P 500 by 29% in 2008.

Across all three business segments, Johnson & Johnson has a total of 26 drugs and product platforms which each generate over $1 billion in sales, giving it the diversification it needs to generate consistent free cash flow and steadily grow its dividend.

To remain competitive, the company invests over $7 billion in research and development each year. While the development of new drugs is risky, Johnson & Johnson has an excellent track record and can use the predictable cash flows from its consumer businesses to steadily fund new product research.

These are all good things that Buffett looks for when he invests, and the string of lawsuits weighing on J&J seem very unlikely to threaten the firm’s dividend.

15: Delta Air Lines (DAL)

Dividend Yield: 2.8% Forward P/E Ratio: 8.2x (as of 11/18/19)

Sector: Transportation Industry: Airlines

Dividend Growth Streak: 6 years

Delta Air Lines is one of the biggest passenger airlines in the world. The company has routes servicing over 340 destinations located across more than 60 countries. Delta Air merged with Northwest Airlines in 2008 to create the largest airline in the world.

Volatile fuel prices, costly union labor forces, steep price competition, and capital intensive operations are just some of the major challenges faced by airlines. There are some positives, however.

The high costs required to operate an airline create barriers to entry. A large operator such as Delta can spread its fixed costs across all of its routes, allowing it to deliver it services more efficiently than smaller rivals or new entrants. Only so many routes between two destinations are needed as well, making it all the more difficult for a new player to gain share.

According to the Wall Street Journal, American, United Continental, Delta Air Lines, and Southwest now control more than 80% of U.S. domestic capacity, up significantly from five years ago prior to the merger consolidation activity.

It remains to be seen if this consolidation can result in a more rational competitive environment, marked by higher ticket prices and improved profitability from economies of scale and restructuring initiatives.

These qualities help Delta generate great free cash flow and earn a higher return on capital, which creates potential for faster earnings growth. Given the size of Warren Buffett’s portfolio, the firm needs to invest in rather capital intensive businesses that are big enough investment targets. Airlines apparently fit the bill, but they remain in the “too hard” bucket for me.

16: Bank of New York Mellon (BK)

Percent of Warren Buffett’s Portfolio: 1.7%

Dividend Yield: 2.6% Forward P/E Ratio: 11.9x (as of 11/18/19)

Sector: Financials Industry: Major Regional Banks

Dividend Growth Streak: 9 years

The company’s investment management business offers a range of investment strategies (e.g. equities, fixed income, alternatives), investment vehicles (e.g. mutual funds, separate accounts), and wealth management services (e.g. estate planning, private banking).

BNY Mellon’s investment services include execution and processing of trades, servicing investments (e.g. outsource middle office functions, safekeep assets), and capital and liquidity services (e.g. optimize funding and operating capital, access global markets).

Warren Buffett’s Berkshire Hathaway bought its first shares of Bank of New York Mellon during the third quarter of 2010 and boosted his stake significantly in 2017 and 2018.

One of the reasons why Warren Buffett might have been attracted to BNY Mellon is because the company is solely focused on the investment process and the investment life cycle. As a result, the firm has amassed strong market share positions across most of its businesses.

This has helped BNY Mellon build up sizable scale in its markets, enabling it to provide the most cost-effective and comprehensive services to its clients.

The company seems very likely to remain a pillar of the world’s investment infrastructure and will continue being relevant and highly profitable for many years to come. The business also stands to benefit if interest rates normalize.

17: M&T Bank (MTB)

Dividend Yield: 2.5% Forward P/E Ratio: 12.0x (as of 11/18/19)

Sector: Financials Industry: Major Regional Banks

Dividend Growth Streak: 2 years

The company acquired Hudson City Bancorp in late 2015 for $5.2 billion, increasing its loan portfolio by nearly 30% while providing meaningful opportunities for cost savings and growth in adjacent markets.

The deal further improves M&T regulatory capital ratios, was immediately accretive to book value per share, and offers an attractive internal rate of return of about 18%.

M&T has been one of Berkshire Hathaway’s stock picks since Buffett bought preferred stock in the company back in 1991. His shares later converted into common stock about five years later.

As a result, M&T has consistently outperformed its peers as measured by profitability, efficiency, and net charge-off ratios. The company has also grown its net operating earnings per share by 15% per year since 1983 and avoided posting a loss each year since 1976, steadily compounding its value along the way.

Shareholders have also been rewarded over this time period, enjoying 13% annualized dividend growth since 1983 and an annual total return north of 17% since 1980 – that’s among the 30 best returns of all U.S.-based stocks that traded publicly since 1980.

18: Procter & Gamble (PG)

Percent of Warren Buffett’s Portfolio: 0.02%

Dividend Yield: 2.4% Forward P/E Ratio: 24.3x (as of 11/18/19)

Sector: Consumer Staples Industry: Soap & Cleaning Preparations

Dividend Growth Streak: 62 years

Buffett had gradually been reducing his stake in P&G over the last decade and announced an agreement in late 2014 to buy Duracell from P&G in exchange for his shares of P&G.

The deal closed in 2016, so Buffett’s remaining P&G stake is extremely small. However, Berkshire Hathaway likely wanted to own Duracell because of its strong brand recognition and market share (25%). It’s also worth noting that Duracell was part of P&G’s acquisition of Gillette, so Buffett had plenty of familiarity with the company already.

19: Synchrony Financial (SYF)

Percent of Warren Buffett’s Portfolio: 0.3%

Dividend Yield: 2.4% Forward P/E Ratio: 8.3x (as of 11/18/19)

Sector: Financials Industry: Consumer Loans

Dividend Growth Streak: 3 years

Warren Buffett is no stranger to Synchrony Financial’s business (credit cards), which was the consumer finance unit spun out from General Electric in 2015. Berkshire had a stake in GE since the financial crisis, and the firm owns a stake worth more than $10 billion in American Express (AXP) and smaller positions in Visa (V) and Mastercard (MA).

Synchrony’s card volume should presumably rise over time as its partners continue expanding their businesses and more shopping takes place online, which requires greater use of credit cards rather than cash.

SYF’s stock sold cratered nearly 20% in late April 2017 after reporting weak earnings. The company’s revenue grew 14% year-over-year, but investors worried after seeing that Synchrony increased its provision for loan losses by 45%, reducing the earnings outlook for 2017 and bringing into question the quality of the firm’s loan book.

Berkshire saw an opportunity to pounce on the stock and took it. Buffett seems to believe that Synchrony has a number of long-term growth opportunities and that its spread business remains in good shape, even after accounting for the higher charge-off rate.

20: Travelers Companies (TRV)

Percent of Warren Buffett’s Portfolio: 0.4%

Dividend Yield: 2.4% Forward P/E Ratio: 12.8x (as of 11/18/19)

Sector: Financials Industry: Property and Casualty Insurance

Dividend Growth Streak: 14 years

Buffett loves the insurance industry’s business model. Specifically, property and casualty insurers like Travelers collect money upfront when they sell a new policy. However, until claims are made, they don’t have to pay the money back.

In the meantime, this pool of money can be invested in stocks and bonds to earn a return. So long as the insurer is skilled at risk management, in theory it should mint money.

Travelers certainly fits the bill and has proven to be a disciplined operator over the years. Throughout the last five years the firm’s average combined ratio (incurred losses and expenses divided by earned premiums) sits below 100% in both its commercial and personal insurance lines, meaning they turned a profit on average before taking investment gains into account.

With such impressive scale, including being the only carrier with a top five market position in all major commercial product lines, Travelers also benefits from the vast amounts of claim data it can crunch to better price its policies. The firm can also meet more of its customers’ needs, gaining greater wallet share and efficiencies.

Thanks to these advantages, management targets a mid-teens return on equity over time, which is about double the industry average. However, the underwriting cycle is notoriously cyclical due to its high competitive intensity; anyone with enough capital can sell an insurance policy.

Travelers has shown great discipline by pulling back on growth when the industry’s policy terms are unfavorable, helping preserve its profitability.

Simply put, Travelers possesses many of the qualities Buffett likes in a business. TRV’s stock declined more than 15% from its January 2018 high through early July 2018, providing an opportunity for Berkshire to initiate a position.

The property and casualty insurance industry faced tough times last year due to an unusually high number of natural catastrophes, but Berkshire’s ground-level visibility and conviction to put some money to work in Travelers suggests better times could be ahead.

21: Goldman Sachs (GS)

Dividend Yield: 2.3% Forward P/E Ratio: 9.3x (as of 11/18/19)

Sector: Financials Industry: Investment Brokers

Dividend Growth Streak: 7 years

Warren Buffett’s history with Goldman Sachs dates back to the financial crisis. Berkshire Hathaway purchased $5 billion shares of preferred stock that paid a high-yield dividend of 10%.

Warren Buffett also received warrants that were later converted into roughly $2 billion of Goldman Sachs’ shares.

The company remains the number one ranked merger advisor and equity underwriting franchise and does investing banking business with over 8,000 clients across 100 countries. The firm clearly dominates the M&A market.

While banks are still contending with a challenging regulatory and macro environment today, Goldman will remain a key player in finance for decades to come.

22: Bank of America (BAC)

Percent of Warren Buffett’s Portfolio: 12.4%

Dividend Yield: 2.2% Forward P/E Ratio: 11.2x (as of 11/18/19)

Sector: Financials Industry: Diversified Banks

Dividend Growth Streak: 6 years

Warren Buffett became involved with Bank of America back in 2011 when he purchased $5 billion of preferred stock yielding 6% and received warrants for 700 million shares that Berkshire could exercise over the next 10 years.

“As recently as 2014, Bank of America’s results were dogged by tens of billions of dollars in penalties over financial-crisis era issues. Since then, the company’s legal problems have eased and it has made a concerted effort to cut costs and focus on safer businesses like lending to consumers with good credit.”

Buffett is no stranger to banks and owns a number of financial services firms in Berkshire’s portfolio. As long as they manage risk well and are conservatively run, banks mint money. Bank of America made one bad decision after another leading up to the financial crisis, but Buffett is clearly a believer in its new leadership and their ongoing turnaround plans for the company.

23: Mondelez International (MDLZ)

Percent of Warren Buffett’s Portfolio: 0.01%

Dividend Yield: 2.1% Forward P/E Ratio: 20.8x (as of 11/18/19)

Sector: Consumer Staples Industry: Miscellaneous Food

Dividend Growth Streak: 6 years

Kraft Foods spun off Mondelez in October 2012. Mondelez is a giant food company focused primarily on snack products (85% of sales). The company owns iconic brands such as Oreos, Ritz, Chips Ahoy, Cadbury, and Trident.

Berkshire Hathaway’s small position in Mondelez dates back to late 2012 when Kraft Foods completed its spin-off of the company through a stock distribution.

Warren Buffett was an existing Kraft Foods shareholder and therefore received shares of Mondelez.

Given Berkshire Hathaway’s stake in Kraft Heinz, we know that Buffett likes this type of business. It’s simple to understand, sells essential products, owns a portfolio of strong brands, generates highly predictable cash flows, and can cut costs to drive margins higher.

The global snacking market also offers plenty of room for growth. The company estimates its size at more than $1 trillion and expects growth to be driven by rising consumption in emerging markets.

With number one global market share positions in biscuits, candy, and chocolate, Mondelez should benefit over time as consumption grows.

While Mondelez is far from an exciting business, Warren Buffett’s “slow and steady” investment strategy has been a good one.

24: American Express (AXP)

Dividend Yield: 1.4% Forward P/E Ratio: 13.7x (as of 11/18/19)

Sector: Financials Industry: Miscellaneous Services

Dividend Growth Streak: 8 years

American Express is one of Warren Buffett’s oldest and most successful stock picks. Buffett first invested in American Express in the mid-1960s, and the company remains one of his largest positions today.

While the competitive environment has intensified and new cardholder growth has become more challenging to come by, Warren Buffett’s massive unrealized gains on his shares of American Express will likely keep him in the stock for a long time to come (his tax bill will be enormous once he sells).

25: Southwest Airlines (LUV)

Percent of Warren Buffett’s Portfolio: 1.4%

Dividend Yield: 1.3% Forward P/E Ratio: 12.3x (as of 11/18/19)

Sector: Transportation Industry: Airlines

Dividend Growth Streak: 8 years

As a result, full-service airlines can never compete with Southwest on cost, and the airline has been better able to survive the industry’s unpredictable ups and downs compared to its rivals.

Berkshire Hathaway began buying shares of Southwest during the fourth quarter of 2016, adding a fourth airline holding to its portfolio.

Given the amount of consolidation that has taken place in the airline industry over the last decade (the four largest carriers control over 80% of U.S. domestic capacity), Buffett likely believes “this time is different.”

With more power resting in fewer hands, the airline industry could finally become a more rational and profitable market for the long term. Many investors are biased against the industry given its checkered history, potentially setting up a great investment opportunity. Buffett’s smattering of bets on four different airlines seems to indicate he is bullish on the entire space rather than a single operator.

Remember the last part of Warren Buffett’s quote that we reference above:

“If [the airline industry] ever gets down to one airline it will be a wonderful business…”

26: American Airlines (AAL)

Dividend Yield: 1.4% Forward P/E Ratio: 5.4x (as of 11/18/19)

Sector: Transportation Industry: Airlines

Dividend Growth Streak: 0 years

The high costs required to operate an airline create barriers to entry. A large operator such as American Airlines can spread its fixed costs across all of its routes, allowing it to deliver it services more efficiently than smaller rivals or new entrants. Only so many routes between two destinations are needed, too, making it all the more difficult for a new player to gain share.

It remains to be seen if this consolidation can result in a more rational competitive environment, marked by higher ticket prices and improved profitability from economies of scale and restructuring initiatives.

27: Apple (AAPL)

Percent of Warren Buffett’s Portfolio: 25.9%

Dividend Yield: 1.2% Forward P/E Ratio: 20.2x (as of 11/18/19)

Sector: Technology Industry: Mini Computers

Dividend Growth Streak: 7 years

Apple sells smartphones, tablets, computers, and an assortment of software, services, and accessories. iPhones have been the biggest driver of Apple’s growth and accounted for approximately 63% of the company’s total revenue last fiscal year. Apple computers (Macs) accounted for 10% of sales, and iPads made up another 7%. Software, services, and sales of other hardware such as iPods accounted for the remaining 21% of Apple’s revenue.

Apple is also a free cash flow machine. Over the last decade, Apple’s free cash flow grew from 25 cents per share in fiscal year 2005 to $12.80 in fiscal year 2019. Throughout that period, Apple’s annual return on equity averaged an outstanding 30%.

Of course, history doesn’t repeat itself – especially in the tech sector. Much of Apple’s success was fueled by the mass adoption of smartphones. That market is now saturated, which has caused Apple’s growth to cool off and had sent its stock down nearly 30% before Berkshire stepped in.

As a result, Buffett was able to buy in to the world’s most valuable brand for less than 11 times earnings. Buffett likely didn’t buy Apple for its smartphone franchise but rather for its future growth opportunities. As usual, he is looking out a number of years while the market is focusing on Apple’s next few quarters, which will likely remain challenged due to smartphone saturation.

From self-driving cars to virtual reality, an expanding array of high-margin services, and a slew of other smart devices and software applications yet to be invented, there are numerous paths Apple can pursue for growth.

Buffett generally prefers to invest in more predictable businesses that don’t have to reinvent themselves, which makes his bet on Apple a bit surprising.

28: Costco (COST)

Percent of Warren Buffett’s Portfolio: 0.6%

Dividend Yield: 0.9% Forward P/E Ratio: 35.4x (as of 11/18/19)

Sector: Consumer Discretionary Industry: Discount Retail

Dividend Growth Streak: 15 years

Costco started in 1983 and is the largest wholesale-club retailer in the country. The company operates large membership warehouses that offer members reasonably low prices on an assortment of products covering categories such as groceries, electronics, apparel, and more.

Costco has been one of Warren Buffett’s stock picks since 2000. Berkshire Hathaway scooped up shares after the stock plunged by nearly 40% during the year.

Buffett was very familiar with the company as Berkshire’s vice chairman, Charlie Munger, served on Costco’s board in the late 1990s.

Costco’s advantages begin with its 80 million cardholders (a membership card is required to shop at Costco). The company’s large group of customers provides Costco with excellent purchasing power over its suppliers, helping keep prices below traditional wholesale or retail outlets.

Management also keeps the company focused on providing excellent value by eliminating as many frills and costs as possible. Costco stores are far from extravagant on the inside and even eliminate the use of bags at checkout to save money and price their products lower.

As a result of its low prices, quality merchandise, and simple shopping experience, Costco’s membership renewal rate has been excellent at around 90%.

What’s held Buffett back from buying more of this wonderful business? Unlike its products, the stock rarely looks like a bargain.

In hindsight, Berkshire surely wishes it had loaded up on more shares of Costco back in 2000.

29: Moody’s (MCO)

Percent of Warren Buffett’s Portfolio: 2.4%

Dividend Yield: 0.9% Forward P/E Ratio: 25.3x (as of 11/18/19)

Sector: Financials Industry: Miscellaneous Services

Dividend Growth Streak: 10 years

Warren Buffett bought his first shares of Moody’s back in 2000 around the time that the company went public.

Warren Buffett probably liked Moody’s because of its duopoly position with Standard & Poor’s (regulations have limited the number of ratings agencies), strong pricing power, well-known brand, and essential services (e.g. a company can’t issue a bond without a ratings agency).

Today’s low interest rate environment has led to significant bond issuances around the world, which has helped lift their businesses.

Moody’s continues to be a free cash flow machine and looks to remain a force in the global financial markets for a long time to come.

30: Sirius XM (SIRI)

Dividend Yield: 0.8% Forward P/E Ratio: 30.3x (as of 11/18/19)

Sector: Consumer Discretionary Industry: Radio & TV Broadcasting

Dividend Growth Streak: 3 years

Sirius is a satellite radio company and was founded in 1990. The company makes money by transmitting a number of premium satellite radio channels on a subscription fee basis to its more than 34 million subscribers. Its content covers everything from sports, music, and entertainment to weather, news, comedy, and traffic.

Berkshire Hathaway initiated a position in Sirius during the fourth quarter of 2016, but his familiarity with the company dates back much further. Sirius is controlled by Liberty Media Corporation, a company Buffett is also invested in.

What is the key to Sirius’s successful business model? A base of more than 30 million paying subscribers generates healthy recurring revenue, and every incremental subscriber has a high incremental margin. In other words, it doesn’t cost Sirius much to add a new customer, dropping much of the new revenue straight to the company’s bottom line and increasing margins over time.

As penetration rates continue creeping higher and auto sales grow, Sirius’s business will continue expanding. Breaking into Sirius’s relationships with automakers would be extremely difficult, protecting the company. While the rise of digital music services such as Pandora could pose a threat to satellite radio as cars become more connected, Sirius also has its own internet radio service to help it remain relevant.

Investors should note that Sirius only began paying quarterly dividends in November 2016.

31: Globe Life (GL)

Dividend Yield: 0.7% Forward P/E Ratio: 14.1x (as of 11/18/19)

Sector: Financials Industry: Life Insurance

Dividend Growth Streak: 14 years

Globe Life, formerly known as Torchmark, is a major provider of life and health insurance products. The company primarily distributes its insurance products through exclusive agency and direct response marketing channels and targets the middle-income market.

Warren Buffett’s stake in Globe Life dates back more than 15 years, and Buffett is no stranger to insurers. After all, one of his most legendary investments ever was Geico.

The insurance business model is an enticing one because insurers receive money upfront when they write new policies, but they don’t have to pay the money back until claims are made.

In the meantime, they can invest policy premiums in bonds and stocks to earn a return. As long as the insurance company is savvy and conservative when it comes to risk management, they can mint money.

As a testament to its sturdiness, Globe Life generated a double-digit return on equity throughout the financial crisis.

Globe Life seems likely to remain in Berkshire Hathaway’s portfolio for a long time to come as it continues compounding its earnings.

32: Visa (V)

Percent of Warren Buffett’s Portfolio: 0.8%

Dividend Yield: 0.7% Forward P/E Ratio: 28.9x (as of 11/18/19)

Sector: Business Services Industry: Financial Transaction Services

Dividend Growth Streak: 10 years

Berkshire Hathaway first bought Visa shares in late 2011. As a long-term investor, Warren Buffett and his team are thinking about what Visa looks like at least 10 years from now.

They are most likely encouraged by the fact that cash transactions still account for the far majority of total transactions around the world.

33: MasterCard (MA)

Dividend Yield: 0.5% Forward P/E Ratio: 32.6x (as of 11/18/19)

Sector: Business Services Industry: Financial Transaction Services

Dividend Growth Streak: 7 years

MasterCard operates the second biggest payments network after Visa and enables business and consumers to use electronic payments instead of cash and checks.

The company makes money by charging fees to card issuers and acquirers for using its transaction processing services. MasterCard collects a fee based on the number and value of transactions completed using its branded cards.

Closing Thoughts

By remaining focused on simple, high quality businesses trading at reasonable prices, we can construct a sound dividend portfolio that can deliver safe, growing dividend income for years to come.