Patient investors can generate winning returns by holding onto great stocks through the highs and lows of the market.

Finding companies with the potential to supercharge an initial investment in the years ahead may seem like a challenging exercise in the current volatile market, but the reality is far less bleak.

While investors will likely have to contend with more choppy waters and fears of a recession, compelling businesses relying on strong, proven models can help investors profit over the long term.

Let’s say you’re on the hunt for stocks with supercharged growth potential and have $10,000 to invest. You should always be investing according to your personal risk tolerance and portfolio goals, and with a minimum buy-and-hold horizon of three to five years.

With that in mind, here are three stocks to consider putting all or part of that $10,000 investment amount toward that could multiply your initial position by five times over the next few years and well beyond.

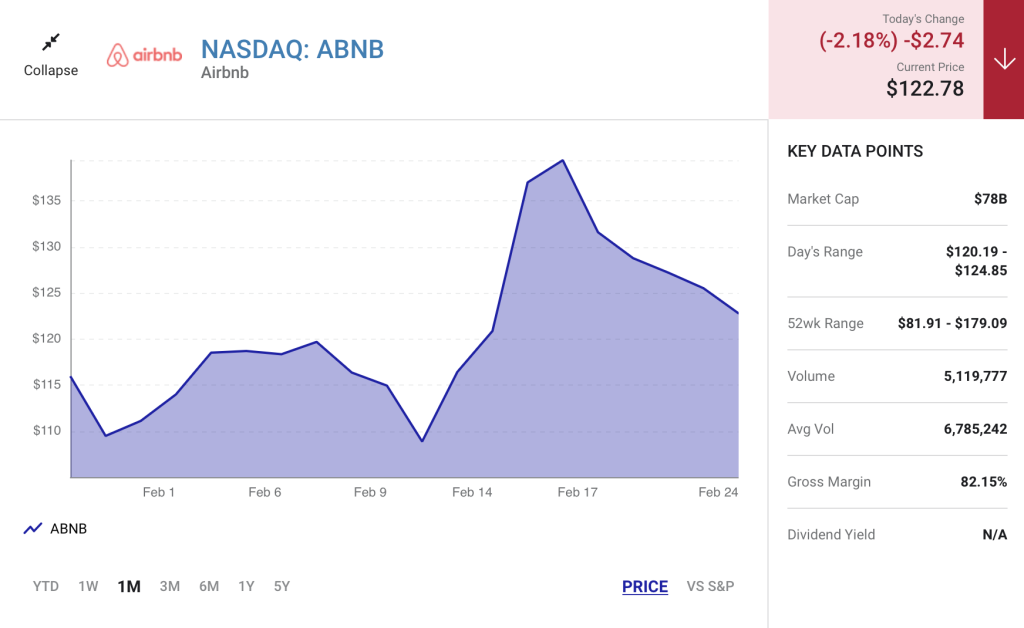

1. Airbnb

Airbnb (ABNB -2.18%) remains a stand-out business against the backdrop of a volatile travel industry, with a recovery from the worst of the pandemic that handily outpaced that of the competition. There are a variety of factors to which you could attribute the company’s continued impressive performance even as concerns about a recession hover like a cloud over many consumers.

For one, the platform doesn’t just cater to the average leisure traveler. Short-term bookings, as well as the broader recovery in cross-border and urban travel, are all notable catalysts for Airbnb. And even if spending on these kinds of trips were to slow in the near term, over the long-term these are durable modes of travel that consumers will likely continue to spend money on.

Beyond these elements, however, Airbnb is catering to a new kind of traveler, one that became more widespread during the pandemic. These travelers could be digital nomads or part-time remote workers, but the rapid growth of flexible and digital working environments in a post-pandemic era can’t be discounted.

The company’s management has already alluded to the fact that the continued growth of remote work could be a notable tailwind for its business, and this is borne out in the fact that long-term stays continue to account for a sizable chunk of its overall stays.

In fact, as of the end of 2022, 21% of all stays booked on Airbnb’s platform were long-term stays of 28 days or more. Beyond planned improvements to its long-term stay segment and continued upgrades to its platform that benefit both hosts and guests, Airbnb is also looking to generate growth from adjacent industries.

For example, the company recently announced a new growth initiative called Airbnb-Friendly apartments, which allows users to search for apartments with landlords amenable to letting them sublet on Airbnb when away on vacation or a trip.

For investors with a multi-year buy-and-hold horizon, Airbnb’s broad potential within the travel industry — and beyond — as it continues to cater to the evolving needs of travelers creates a buying proposition that begs a second look.

Bear in mind that while the stock is still trading down 22% from one year ago, shares rebounded by approximately 50% since the start of 2023 alone. It’s certainly not a stretch of the imagination that this profitable business (the company recorded net income of nearly $2 billion in 2022) could continue to leave the competition in the dust in the years ahead. And in a bull market environment, these underlying catalysts could easily drive shares skyward and generate multi-bagger returns for faithful investors.

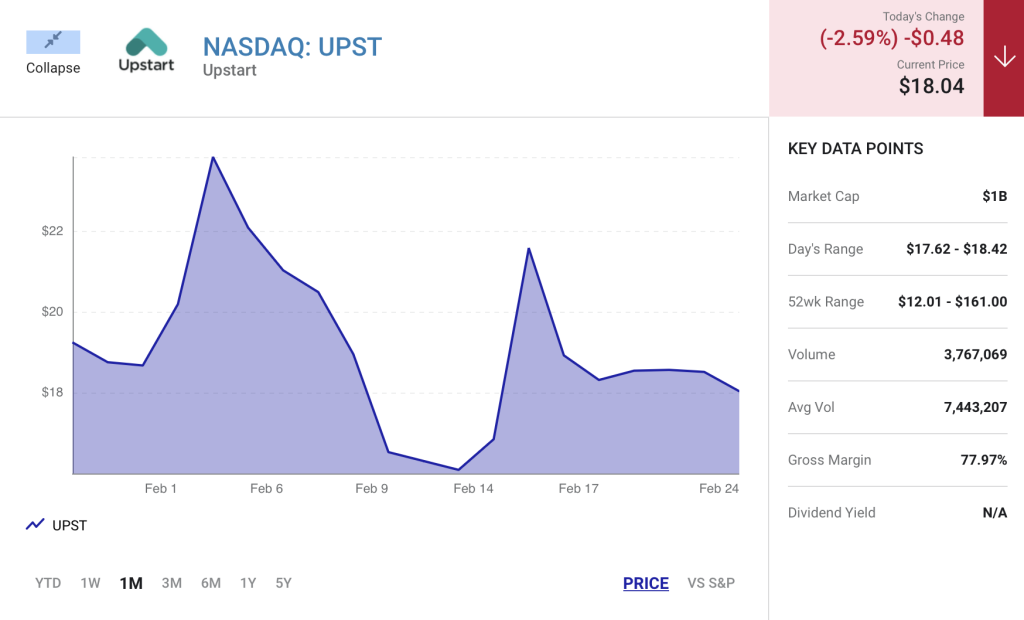

2. Upstart

Upstart (UPST -2.59%) hasn’t had an easy time lately. Some of these challenges could be attributed to factors outside of its control, while others are tied more closely to the underlying business.

The company relies on its proprietary lending platform, powered by over 1,000 data points including information beyond the traditional FICO score, to assess whether to approve a consumer for a loan. This system enabled it to not only outpace the approval rates of traditional lenders, but do so at a lower loss and default rate.

As of the end of 2022, 82% of loans processed through Upstart’s platform were done on a fully automated basis — meaning no human element involved in the approval process.

There are several distinct reasons that the stock has been sold off (and perhaps oversold) lately. Upstart has been unprofitable in recent quarters, revenue declined, lending volume contracted, and the quantity of loans it carries on its balance sheet increased.

Meanwhile, fewer consumers are applying for loans in the current elevated interest rate environment. At the same time, its proprietary platform is approving fewer loans due to the increased level of default risk the current environment portends. And institutional investors — who historically funded the lion’s share of Upstart’s loans — are buying fewer loans.

In short, a perfect storm. However, green flags remain on the horizon.

For one, the fact that Upstart’s platform is approving fewer loans, even as more lending partners are jumping onboard and automation is increasing, means that its model is working as designed. The platform calibrates to the risks present in any given environment. So it follows that if the current environment would necessitate fewer loan approvals, a more favorable economic landscape would have the inverse effect.

And if anyone were in doubt about Upstart’s platform’s ability to self-improve, management said in the 2022 earnings report that its platform had learned as much in the last seven months as in the entire preceding few years.

Meanwhile, the company closed out the year with 120% more bank and credit union partners than it had in the prior year. Upstart is widening its footprint in many lucrative lending areas, including auto lending, which alone represents a total addressable market of approximately $780 billion.

Over the long term, Upstart’s rapidly expanding footprint in diverse, multi-billion-dollar sectors of the broader lending market, its still-growing slate of institutional partnerships, and the power of its proprietary AI-driven platform give it a competitive edge that could not only change but disrupt the long-held patterns of this industry.

This may be just too compelling for some investors to pass up, and it’s not difficult to see how these advantages could drive loan volume, profitability, and the stock back skyward in a rebounding market environment. The fintech stock is still trading down 85% from one year ago, but shares have popped 44% since the beginning of 2023 at the time of this writing.

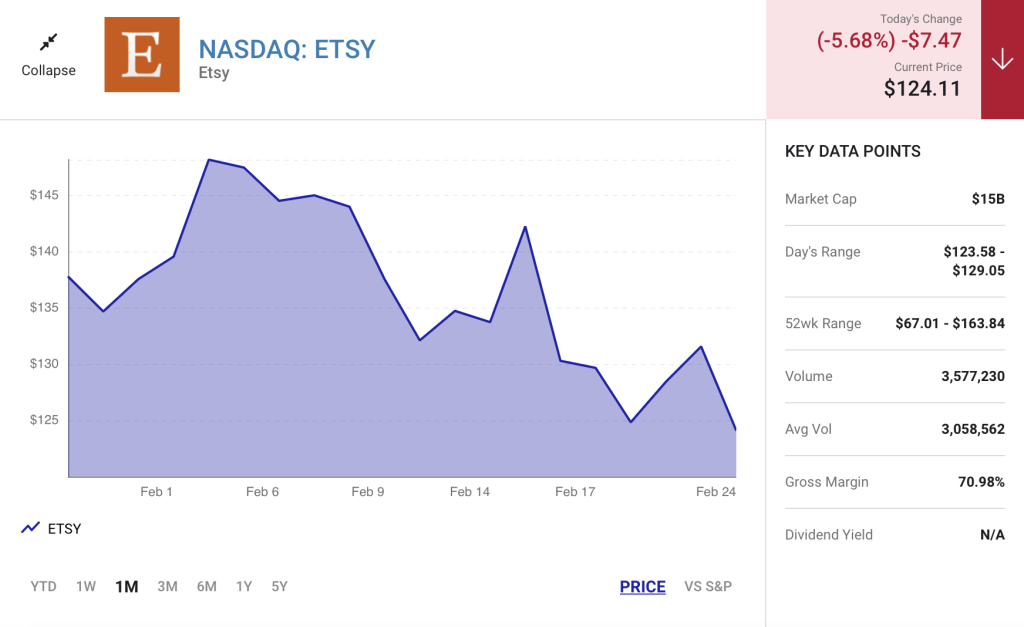

3. Etsy

Etsy (ETSY -5.68%) is another pandemic-era favorite that saw shares recede over the past year, even as the stock is still trading up by about 10% since the start of 2023. The company has built a robust business around a niche-but-rapidly-expanding segment within the broader e-commerce space. While one might think that the market for vintage, specialty, handmade, or otherwise unique goods isn’t particularly broad, the truth is quite the opposite.

Currently, management estimates the total addressable market for the Etsy.com platform alone is upward of $2 trillion. This doesn’t include other businesses within Etsy’s family of brands, such as the musical instrument marketplace Reverb or Depop, the popular Gen Z platform for buying and selling second-hand fashion.

Etsy is not without competition, but there are few companies public or private that operate at the scale the company does or act as direct competitors.

For example, while Amazon is one of the most well-known e-commerce companies in the world, its platform isn’t as concentrated on unique subsectors of the industry. While you might go to a platform like Amazon’s for a range of items, from fashion to household or travel supplies, you’re not as likely to go there for — or be able to find — one-of-a-kind, vintage, or handmade pieces.

In the third quarter of 2022, Etsy’s gross merchandise sales totaled $3 billion, a 150% increase from the same quarter in 2019. At the same time, the number of active buyers and repeat buyers on Etsy’s platform soared by respective amounts of 100% and 125% on a three-year basis.

The novelty of Etsy’s platform, its continued disruption of a vast and expanding industry (management still estimates it has only penetrated about 3% of its total addressable market), and the overall growth of its business from pre-pandemic levels bode well for its ongoing recovery, particularly as consumer spending becomes less volatile.

These strong underlying elements of its business could also induce a robust recovery for the stock over time. For investors looking to buy and hold a unique business in the e-commerce space with vast untapped potential, this prospective multi-bagger looks like a no-brainer stock to buy and hold through the next bull market and well beyond.

Read Next – Obama Back in the White House?

Obama is back?

Just take a look at the new weapon Biden is unleashing upon American citizens.

It’s actually something Obama originally pushed forward.