As pessimism runs high, some stocks have fallen to unsustainably low valuations.

The fast-moving stock market lends itself to high volatility. That factor may or may not work in favor of investors, though prospective buyers can find bargains if they exercise enough patience.

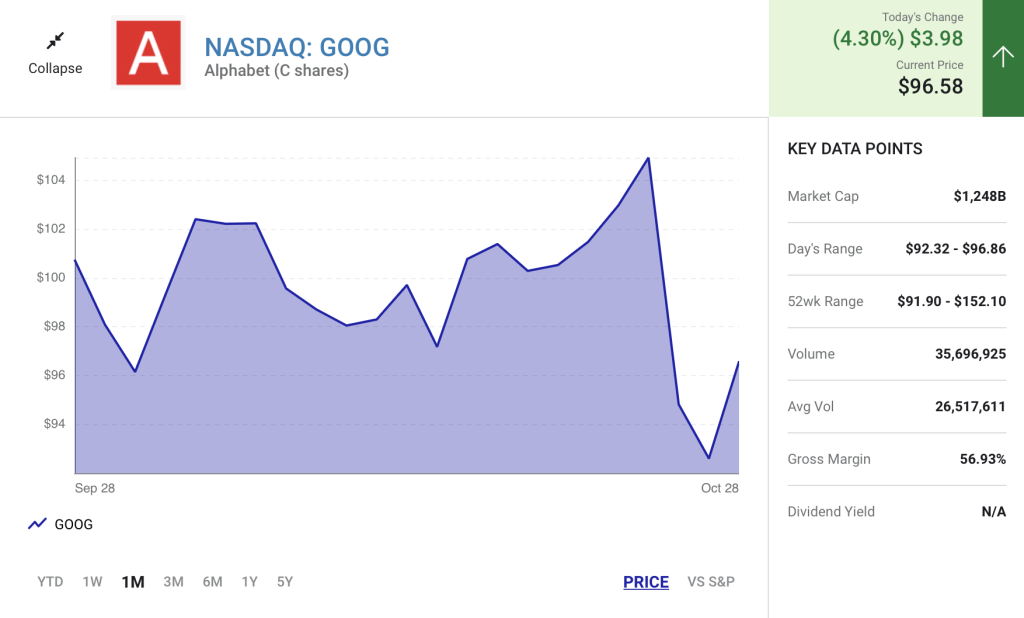

However, the current down cycle is the most severe since the 2008 financial crisis. That factor could mean an opportunity to buy growth tech stocks that may not return for many years. Investors looking for these once-in-a-decade buys may want to consider Alphabet (GOOGL 4.41%) (GOOG 4.30%), MercadoLibre (MELI 5.37%), and Salesforce (CRM 2.05%).

Shares of this internet giant are selling at a major discount

Jake Lerch (Alphabet): Here’s a hypothetical: If you could go back in time and buy $10,000 worth of Alphabet shares on the day of its initial public offering (IPO), would you do it? Similarly, would you invest $10,000 in Alphabet on March 13, 2020, the start of the COVID-19 pandemic, as the entire stock market was plummeting?

Of course, with the benefit of hindsight, we know those investments would have paid off. If you had bought $10,000 worth of Alphabet class C shares when they debuted in 2014, they would now be worth $34,700. A similar investment made in March 2020 would have grown to $15,800.

I bring this up because those two dates appear like the best once-in-a-decade opportunities to have bought shares of Alphabet. And, as I’ve mentioned, they were great times to buy shares. Anyone who did has made a solid profit on their investment.

However, today may seem like the wrong time to bet on Alphabet. The company just reported a lackluster quarterly report. Overall revenue growth slumped from 41% to 6%. YouTube, one of Alphabet’s biggest growth engines, saw its ad revenue decline for the first time ever on a year-over-year basis.

Yet, despite an admittedly poor report, now seems like that once-in-a-decade opportunity. Why? Valuation. On a valuation basis, Alphabet shares are historically cheap. In fact, they’re closing in on their lowest levels ever.

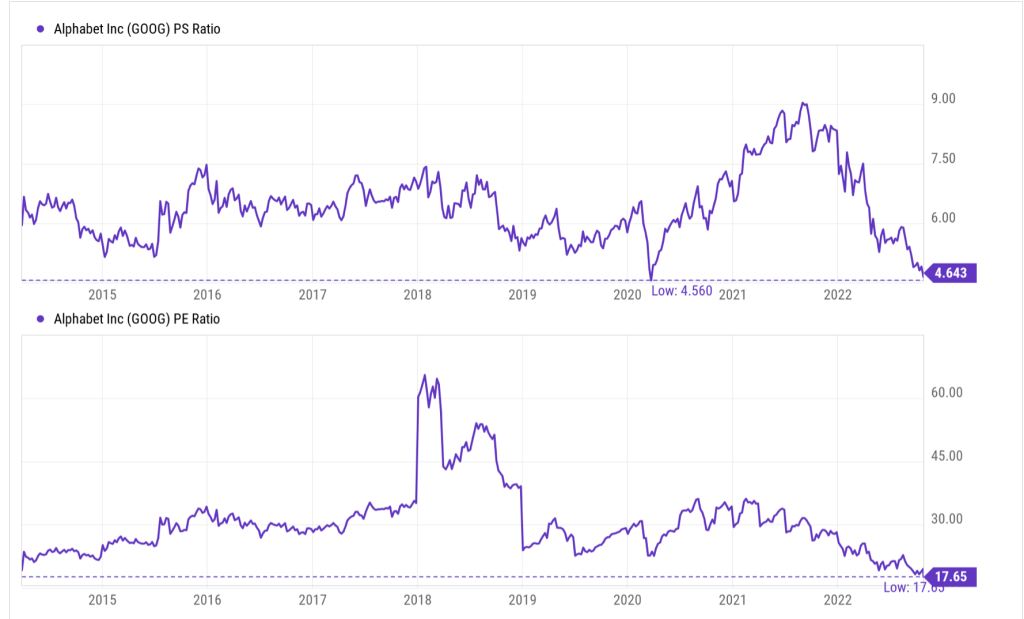

There are several ways to measure valuation, but I’ve included two of the most popular measures in the chart above: the price-to-earnings (P/E) ratio and the price-to-sales (P/S) ratio.

While they measure price against two different financial figures (earnings and revenue, respectively), both ratios indicate that Alphabet shares are cheap — extremely cheap. In the case of its P/E ratio, Alphabet shares are at a new all-time low of 17.89.

Obviously, economic conditions are not great right now. Inflation is high, and the stock market is mired in a bear market. But just like in March 2020, the darkest times are often the best times to buy stocks. Looking back many years from now, it might seem evident that October 2022 was the right time to load up on Alphabet. Using valuation as my guide, it sure looks like a once-in-a-decade opportunity to me.

The Latin American tech juggernaut that American investors need to watch

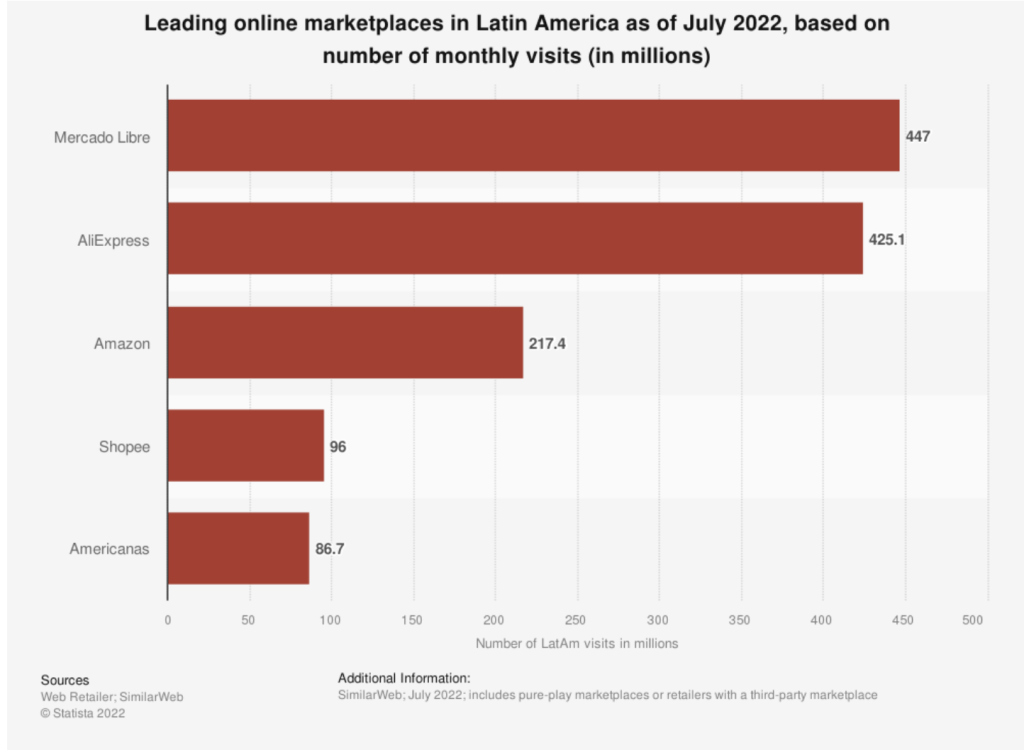

Will Healy (MercadoLibre): MercadoLibre is not a familiar name in the U.S. However, in Latin America, it has evolved into the Amazon of that region. Between the U.S.-Mexico border and the southern tip of Argentina, it is the most commonly visited e-commerce platform.

However, what may drive investor interest is the ecosystem that enhances its e-commerce advantage. Latin America is a cash-based society. To make digital payments possible, MercadoLibre created Mercado Pago. That has since evolved into a fintech product that consumers can now use for non-MercadoLibre purchases and loans.

Also, to address shipping and fulfillment-related challenges, the company created Mercado Envios. These and other businesses create synergies that can help the company fight off challenges from Amazon, Sea Limited‘s Shopee, and numerous other companies.

Despite an environment that has sometimes faced high inflation and political uncertainty, MercadoLibre managed to generate $4.8 billion in revenue in the first half of 2022. This surged 57% compared with the first two quarters of 2021.

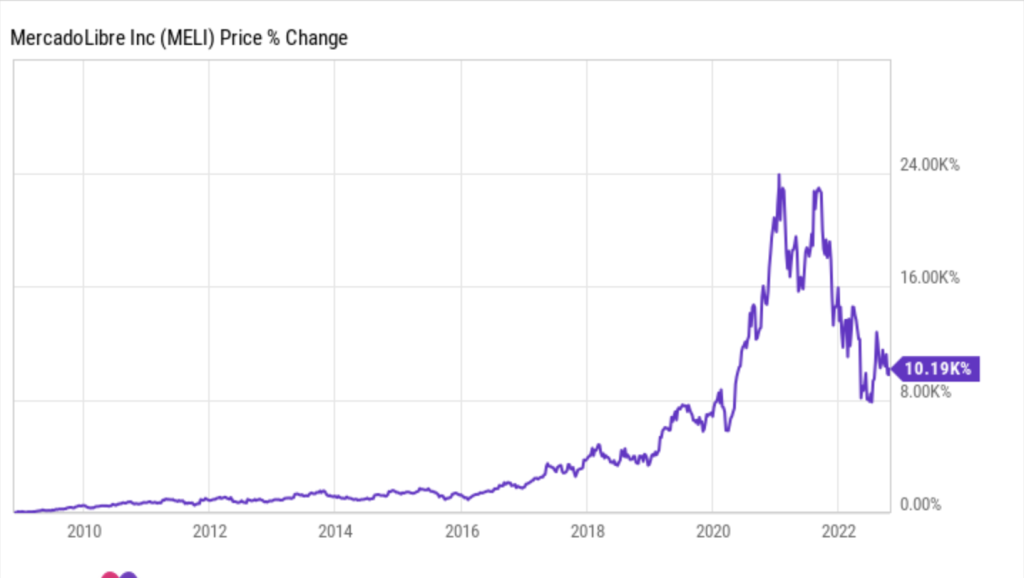

Additionally, it turned profitable on an annual basis last year, a factor that should help it weather the current bear market. MercadoLibre stock has not escaped the bear market, as it has fallen more than 55% from its peak.

Nonetheless, this is where the once-in-a-decade opportunity appears. It currently trades at a P/S ratio of less than five, a level previously reached in 2008. Since that 2008 trough, the stock has risen more than 100-fold!

Admittedly, MercadoLibre stock will probably not repeat that feat. However, with its rapid revenue growth, it could still generate outsize gains as it continues dominating Latin America in e-commerce and fintech.

A more mature Salesforce can still deliver significant investment returns

Justin Pope (Salesforce): Customer relationship management company Salesforce was one of the original enterprise software stocks. Founded at the turn of the millennium, it’s survived the dot-com bust to deliver more than 3,600% total returns since late 2001. Today, Salesforce is a software conglomerate that has developed and acquired its way to having a do-it-all suite of software tools that companies can run their business.

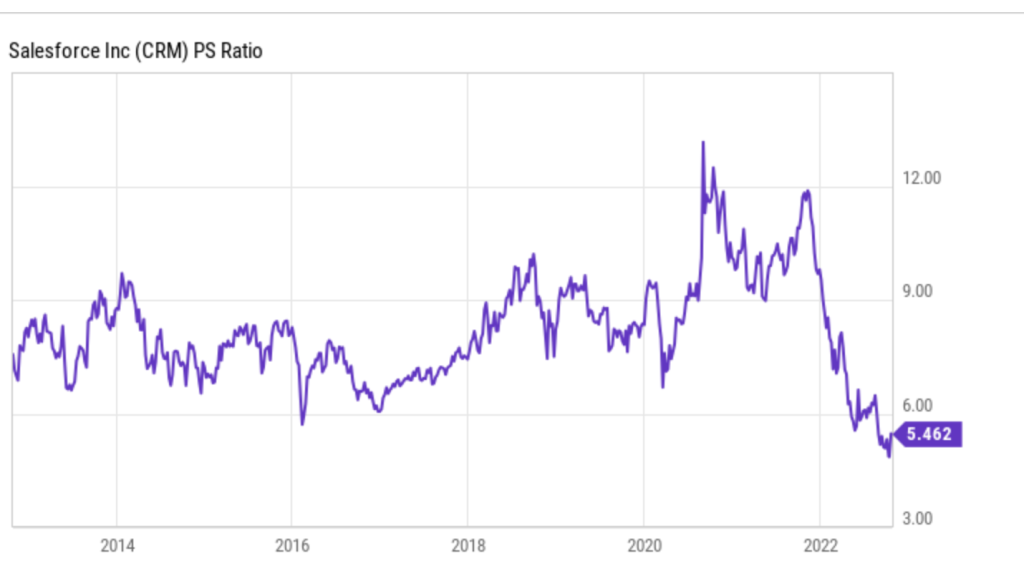

Investors are facing one of the worst bear markets in many years, which has sunk valuations throughout Wall Street. Salesforce stock is trading at a price-to-sales ratio (P/S) of 5.4, its lowest in more than a decade:

Management also believes the stock is cheap. The company authorized its first-ever share repurchase program in August for $10 billion, enough money to retire 6% of all outstanding shares at current prices. Reducing the share count boosts per-share metrics, which means that earnings per share (EPS), Salesforce’s profits per share, will grow faster.

But the company’s revenue isn’t done growing either; management is targeting $50 billion in revenue by the end of the fiscal year 2026, an average of 17% growth annually between now and then. A growing addressable market and cross-selling across its business should drive this growth. While Salesforce’s best growth years are probably behind it, the stock should still have plenty left in the tank, which could translate to significant long-term gains for shareholders.

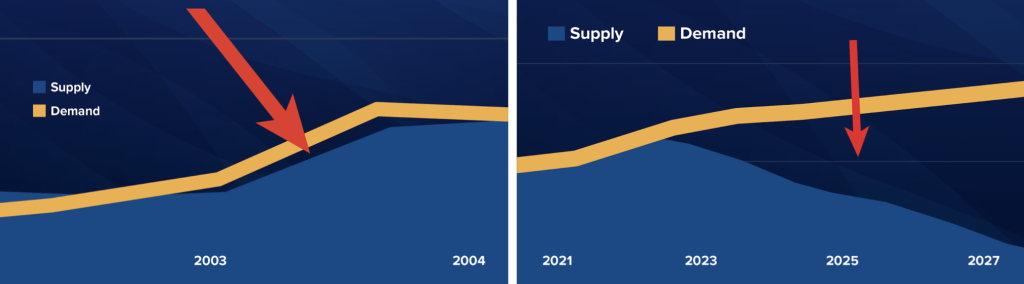

Read Next – Warning: Massive Supply crisis ahead. Act now.

Even as inflation continues to cripple investors, and the economy heads into a recession…

The demand for one element is set to soar.

In fact, some countries have already begun stockpiling it to get ahead of the curve.

The last time supply and demand of this key element got slightly imbalanced, savvy

investors could’ve made 30x their money in less than 6 years.

Take a look at these two charts…

The one on the left shows the slight surge in demand that resulted in 30x gains.

The one on the right is the widening chasm between supply and demand that could start as early as this coming January.

Consider this: If the tiny blip in demand helped investors 30x their money last time…

Imagine the huge gains we could see when demand completely overwhelms supply.

But I don’t want you to rush in blindly.

Before you buy a single share of stock to take advantage of this event, I urge you to see what’s causing this massive shift right here.

P.S. Some of the biggest investment gains have been made during bear markets. It’s all about knowing what’s going drive demand before the rest of the world catches on. And right now, you have a chance to profit off that situation. Click here for my specific instructions.