Analysts are optimistic about S&P 500 stocks in 2022, though some of their enthusiasm has waned after a rocky start to the year. Investors have adjusted themselves for what may be a very different year on Wall Street, with predictions of increased interest rates on the road to the wind-down of the “stay-at-home trade” that propelled profits in 2021.

In the aftermath of results, there have been several significant disruptions to corporations, including a stock market crash in high-profile equities like Facebook parent Meta (FB) and streaming behemoth Netflix (NFLX). As a result, Goldman Sachs (GS) analysts recently decreased their S&P 500 price prediction for year-end 2022 from 5,100 to 4,900.

And there is an opportunity for investors for every challenge. As we head into the second half of 2022, it’s worth looking at the stocks that the analyst community is most enthusiastic about right now.

That being said, let’s take a look at just three stocks (for now) within the S&P 500 index that are buy-rated and performing well, making them smart portfolio picks:

Signature Bank (SBNY)

Signature Bank (SBNY) is a regional financial stock specializing in commercial banking, consumer checking accounts, mortgage lending, and similar services. SBNY isn’t a small company, with a market capitalization of $20 billion and yearly revenue of roughly $3 billion, but it isn’t on par with global behemoths like JPMorgan Chase (JPM). That’s actually a beneficial thing for low-risk investors. SBNY does not engage in high-risk proprietary trading or aggressive investment banking operations that might cause market disruptions. In a rising interest rate environment, where Signature can charge higher margins on its loans, SBNY‘s day-to-day operations are now benefiting from a strong tailwind.

SBNY had a very good 2021. The business easily bested Wall Street’s analyst projections on both EPS (Earnings-per-share) and Revenue for the past four consecutive fiscal quarters. SBNY’s year-over-year numbers are all in the green, indicating further growth. SBNY currently pays a dividend yield of 0.7%. SBNY, for the current quarter, shows us $603.3 million in sales, at an EPS of $4.27 per share. The forecasts show growth on both a quarterly and annual basis. SBNY has a consensus price target of 435.00 among the analysts who provide 12-month price estimates, with a high of 508.00 and a low of 385.00. The estimate is up 27.20% from current pricing, and SBNY boasts a strong buy rating.

Monolithic Power Systems Inc (MPWR)

Monolithic Power Systems (MPWR) is a specialist semiconductor design corporation that serves a variety of sectors, including automotive, industrial, communications, and consumer goods. In addition to power system solutions, MPWR also offers lighting control systems, such as those used in LCD panels for laptops and televisions. A variety of businesses are being impacted by global supply chain disruptions and a chip scarcity. The realities of supply and demand, on the other hand, imply that the lesser number of chips will be more expensive, and firms like MPWR will be able to operate at total capacity while still doing so profitably.

MPWR shares two very impressive traits with the aforementioned Signature Bank: The business has crushed analysts’ expectations on EPS and Revenue for the past four quarters (making for a successful 2021). Also, MPWR currently pays a dividend yield of 0.7%. Their year-over-year numbers are all in the green, and the forecasts indicate growth on both a quarterly and annual basis. For its current quarter, MPWR so far shows us $360.4 million in sales, at $2.26 per share. MPWR has a consensus 12-month price target of 568.00, with a high of 630.00 and a low of 510.00 among analysts that provide annual price forecasts. The forecast implies an increase of 18.53% over current pricing, and the consensus gives MPWR a solid buy rating.

Alexandria Real Estate Equities Inc (ARE)

One of the likely lesser-known names here is Alexandria Real Estate Equities (ARE). It is a $30 billion commercial real estate firm with offices in major U.S. cities like New York, San Francisco, Seattle, and Boston. ARE receives corporation tax incentives in exchange for a requirement to return 90% of taxable revenue to shareholders as a real estate investment trust (REIT). Investors should expect significant dividends from this company, as well as upside potential, thanks to ARE’s business model and long-term leasing agreements with essential clients in attractive regions.

Like its peers on this list, ARE had a very impressive 2021. It also bested the Wall Street expert projections on EPS and Revenue in each fiscal quarter. Its current quarter (until they report earnings again) shows us $587.7 million in sales, at 93 cents per share. ARE currently pays a dividend yield of 2.5%. The experts’ forecast indicates positive future growth in both EPS and revenue on both a quarterly and annual basis. The consensus price target for ARE from the analysts that provide 12-month predictions is 233.00, with a high of 245.00 and a low of 219.00. The median is up 25.86% from its most recent price, and the experts are telling us to buy stock in ARE.

Should you invest in Alexandria Real Estate Equities Inc right now?

Before you consider buying Alexandria Real Estate Equities Inc, you'll want to see this.

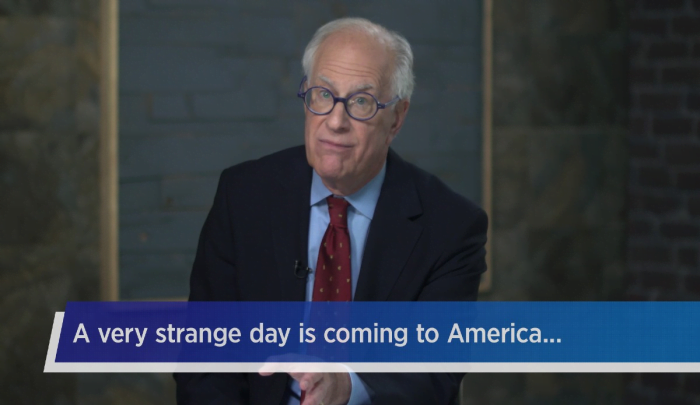

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Alexandria Real Estate Equities Inc.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...

You might also like:

- An estimated $2.2 Trillion Move Against China?

- Buy alert: Move $1,000 before Tesla’s Optimus launch

- Trump to “Reset” U.S. Economy on Scale Not Seen in 50 Yrs

- Nvidia CEO Makes First Ever Tesla Announcement

- 2 Nobel Prize winners warn of once-in-a-generation wealth shift…

- [LEAKED] Trump’s Next AI Executive Orders?

- October 2025 Market Crash?

- GOLD… IT’S TIME

- The next biggest bull run in over 50 years

- Is Oracle the new #1 AI Stock Today? Wall Street Legend Weighs In