Seeking out great stocks to buy is essential, but many would say it’s even more important to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, figuring out which stocks to trim or get rid of is essential for proper portfolio maintenance.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Continue reading to find out which three stocks our team is staying away from this week.

SaaS customer service platform developer Zendesk (ZEN) is first up on our list after announcing plans to buy Momentive (MNTV), a customer experience solutions provider. ZEN would acquire MNTV at the cost of $4 billion in stock, which equates to almost one-third of Zendesk’s market cap.

The pros on Wall Street were not pleased by the acquisition that Zendesk said will be “growth accretive” by 2023. Analysts slashed their ratings and price targets on Zendesk because of the hefty dilution and the risk of spending so much on a business that’s growing more slowly than the acquirer. Zendesk’s revenue is on pace to grow almost 30% this year, while Momentive is expected to grow by just under 20%.

Piper Sandler analyst Brent Bracelin downgraded ZEN to Neutral from Overweight, lowering his price target to $122 from $175. The analyst sees near-term integration risks and potential shareholder dilution with Momentive shareholders poised to take a 22% ownership stake in the combined Zendesk business post the deal close. He’s comfortable moving to the sidelines, pending better visibility into the combined business models’ combined growth trajectory.

Zendesk was already lagging behind its peers prior to the announced acquisition and more so since. While the WisdomTree Cloud Computing ETF (WCLD), which tracks a basket of cloud stocks, was up 22% YTD as of Friday’s close, ZEN was down 25%.

2021 has been a period of transition for Zendesk. After missing earnings and revenue estimates in July, for the first time since its 2014 IPO, the outcome for ZEN seems murky. With heavy competition in the sales and marketing software markets, ZEN may have to play defense for a while. We’ll be watching from the sidelines until ZEN’s trajectory is clear.

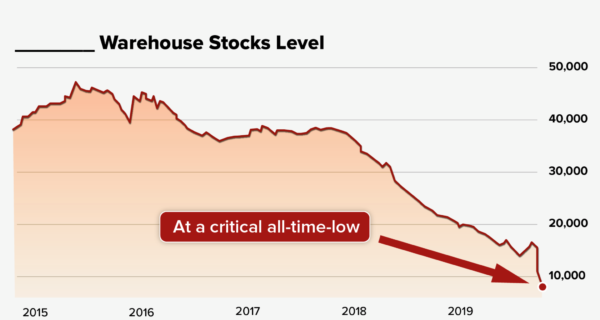

Next up is offshore oil rig service provider Transocean (RIG) suffered severely in the wake of 2020’s economic shutdown and travel bans (when crude prices plummeted to all-time lows), but the company was in bad shape long before that. In 2019 prior to the pandemic, Transocean reported an EPS loss of $1.45. Bank of America analyst Mike Sabella projects that losses will continue through at least 2023.

He’s projecting Transocean will finish 2021 with about $450 million in liquidity, and the company will generate negative $50 million in 2022 free cash flow. Bank of America has an Underperform rating and a $1 price target for Transocean. Considering that Transocean has more than $8 billion in debt and $600 million in 2022 debt maturities, Sabella’s forecast doesn’t seem unrealistic.

The current consensus among the 15 analysts offering recommendations is to Hold RIG. The stock has 10 Hold ratings, 5 Sell ratings, and no Buy ratings. A median target of $2.75 represents a 19% decrease from the most recent price.

Finally, TripAdvisor’s (TRIP) makes our stocks avoid list again, as their voyage downward continues. Since mid-March, TRIP stock price has been stumbling downward and doesn’t seem likely to make the return trip anytime soon. Especially not after major hotel chains joined forces last month to force TripAdvisor to reverse course on its subscription to a cash-back instead of hotel discounts, seemingly taking the wind out of the company’s Tripadvisor Plus program.

“This shift is a big departure for Tripadvisor, having previously pushed Tripadvisor Plus as offering ‘no brainers’ to customers and enticing them with best in class rates,” said Bernstein analyst Richard Clarke. “The new model makes sense and could offer good deals to customers, but will be in a competitive space with Booking.com, Hopper and Revolut also offering cash back/credit on bookings with also charging a $99 fee. This might ultimately be a test if Tripadvisor Plus can be a full-service travel subscription offer, not just a discount club.”

Mizuho analyst James Lee lowered the firm’s price target on TripAdvisor to $42 from $50, citing the disruption in travel trends in Q3 by new delta cases, which caused student travel restrictions and consumer hesitancy heading into October holiday. The analyst believes the travel recovery story has been pushed back to fiscal 2022 instead of the second half of 2021.