Tech stocks are the most important sector of the stock market. For good reason, too.

These companies’ innovations create services and products integral to daily life and are upending traditional industries and business models. Investors craving the explosive growth potential of these innovations can look no further than the best tech stocks to buy now.

Technology stocks come in all shapes and sizes, from well-known global enterprises such as Amazon.com Inc. (NASDAQ: AMZN), Facebook Inc. (NASDAQ: FB), and Apple Inc. (NASDAQ: AAPL) to smaller startups just making their IPOs that could potentially offer massive returns to early investors.

That also means the way we evaluate tech stocks has to be different than the way we evaluate the rest of the stock market.

Tech investors are looking for growth. They want a company with a great idea and a management team committed to making it work. And it doesn’t matter if it’s a startup going public or a tech megacap dominating its sector.

But that doesn’t mean just any tech stock will see the sort of explosive growth investors want. Tech is extremely competitive, and only the best companies with the best ideas and best management hitting their stride at exactly the right time will make investors money.

That’s why we’ve combed through the most promising tech stocks across the hottest trends in tech to find you stocks with real growth potential.

Here are our best tech stocks to buy today…

The Best Tech Stocks to Buy for September 2021

We’re knee-deep in the fall season. While for many, that means the end of summer and a descent into cold, dark weather, tech stocks will still be hot.

The Fed says they will remain in what they call an accommodative mode, so low interest rates will continue to drive stock prices higher. More people are getting vaccinated, so more stores, restaurants, and venues are opening up. As a result, both individuals and corporations are beginning to loosen the purse strings.

A broad market rise provides the perfect background for owning fast-growing technology company stocks that are developing products and programs that are changing the world in the blink of an eye.

To make sure you don’t miss out on any of the fall’s hottest stocks, we’ve got the best tech stocks to buy in September…

The 5G Tech Stock to Buy Now

The rollout of 5G networks continues across the globe, and that is the technology development that could have the biggest impact on the world over the next few years. As we have seen in the pandemic, the faster the broadband speeds and the wider the bandwidths are, the better the world functions.

At the heart of the 5G revolution is Aviat Networks Inc. (NASDAQ: AVNW). Aviat sells a range of wireless networking products, solutions, and services in North America, Africa, the Middle East, Europe, Russia, Latin America, and the Asia Pacific.

Maybe that sounds boring, but what they really sell is all the technology that makes the internet work faster and more efficiently, which means the world works faster and more efficiently.

Aviat is the pure-play microwave solutions company for 5G networks. Microwave signals are faster than light through fiber and will be a huge part of major 5G networks.

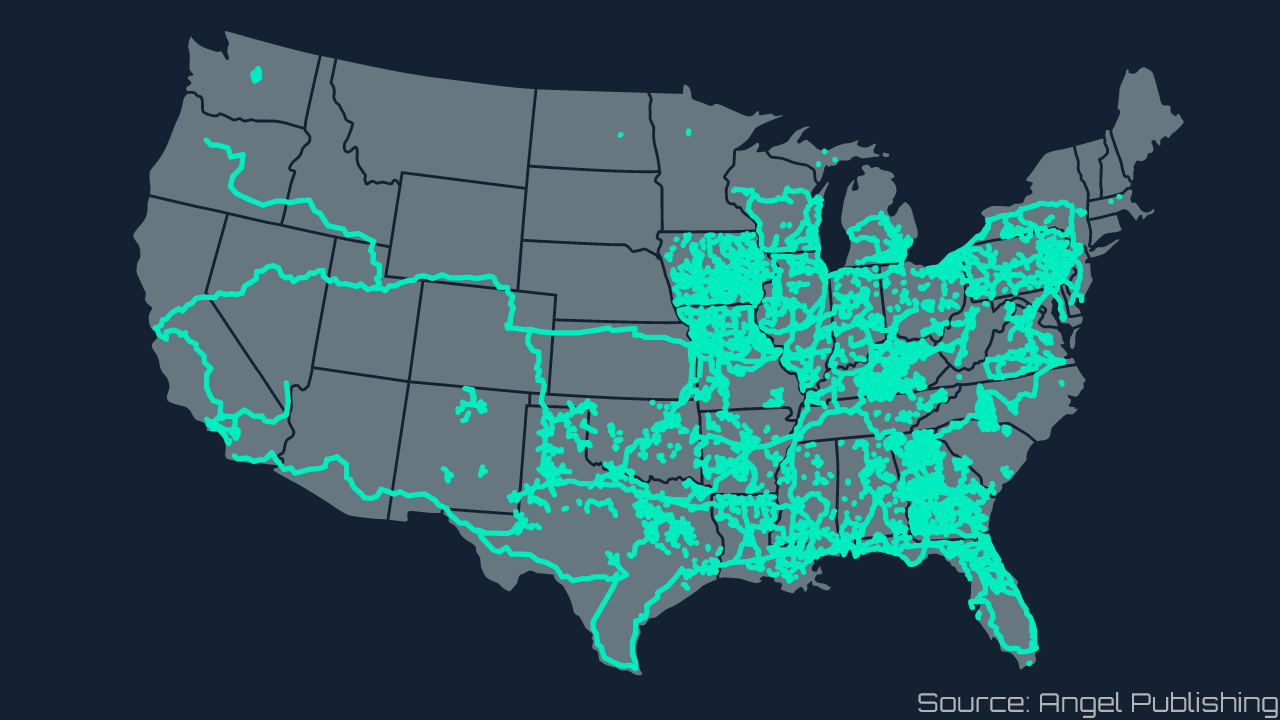

There is another huge growth opportunity in front of Aviat Technologies right now. The Biden infrastructure plan calls for $100 billion to be spent getting high-speed broadband services to the rural parts of the nations. Aviat has been involved in rural broadband projects for years and stands ready to help build the future in those areas.

That same expertise can help bring the internet to emerging economies around the world, and Aviat expects to see growth opportunities from those markets as well.

Aviat is also the leader in using microwave technology for private markets for utilities, law enforcement, and government agencies.

Aviat has been a steady grower, and the company looks to accelerate that growth as 5G brings broadband to rural America.

The Best Tech Stock for the Chip Shortage

Another company that looks poised to blast off is an Israeli semiconductor equipment manufacturer called Camtek Ltd. (NASDAQ: CAMT). Camtek makes products that allow manufacturers to improve yields and drive down costs.

That’s critically important right now as semiconductor companies scramble to produce enough chips to meet the demand. Between the pandemic shrinking production and the explosive demand as the global economy comes back to life, we see a shortage of semiconductors around the world. This has brought some industries like auto manufacturing to a standstill.

Manufacturers like Ford are closing plants while used car prices soar. There simply aren’t enough new cars to keep up with demand. At the same time, tech firms like Apple are warning that their business could slow down thanks to the chip shortage.

Virtually every social, demographic, and economic trend will drive demand for semiconductors and semiconductor testing equipment like the products Camtek provides. We are moving from the growth of PCs and the internet as the big demand driver for the semiconductor industry into the age of big data.

Big data is smart homes.

Big data is 5G.

Big data is artificial intelligence.

Big data is electric vehicles and driverless cars.

Big data is smartphones.

And big data needs semiconductor chips.

Chip manufacturers need the products made by Camtek to produce the chips quickly, cheaply, and profitably.

Camtek has already been growing at a torrid pace. In the first quarter of 2021, revenues were up year over year by over 90%.

With the second quarter earnings release, the company earned $67.5 million in revenue, an increase of 82% on a year-over-year basis. Camtek beat analyst expectations by 6.74% for earnings per share (EPS) and 5.31% for revenue and has a strong operating cash flow of $19.9 million.

Camtek has doubled revenue every four years.

Wall Street analysts are just discovering the stock and have been scrambling to keep up with Camtek’s growth trajectory.

Institutions are starting to notice the stock too. Buyers include well-known growth stock investors like Ark Investments and Driehaus Capital.

The positive earnings surprises, analyst estimate increases, and institutional buying pressure can combine to send stocks dramatically higher very quickly.

Here’s what Camtek’s management had to say about their strong second quarter earnings report: “Management expects continued growth for the second half of 2021 with revenues for the third quarter to be between $69-71 million, implying over 80% growth year-over-year for the first nine months of 2021.”

But the chip shortage is expected to continue into 2023, meaning chip makers will rely on Camtek. Coupled with long-term trends like Big Data, that spells growth for the company over the next two years and beyond.

The Best Tech Stock Right Now for Infrastructure

Bentley Systems Inc. (NASDAQ: BSY) sells software to the people that plan, design, and build infrastructure. These include engineers, architects, and construction firms. As money begins to flow into rebuilding infrastructure, there will be more demand for Bentley’s software.

Its software can be used to design bridges, mines, dams, and factories. Architects can also use their products for site plans, rail network planning, and treatment plant analysis. Before the first shovel of dirt is turned in, the designers and builders can have the project all laid out using software from Bentley Systems.

Bentley’s software creates digital workflow between architects, engineers, and construction companies both in the office and in the field to ensure projects run smoothly and according to plan.

A lot of new infrastructure projects will come online over the next few years, and that’s going to create demand for the software sold by Bentley Systems.

As requested by the president, the infrastructure bill calls for billions of dollars to be spent in updating schools and expanding broadband access to everyone in the United States. That will create enormous demand for fiber optic products, and our next stock to own in May is going to be a huge beneficiary of that demand.

This Top Tech Stock Dominates Fiber Optics

Clearfield Inc. (NASDAQ: CLFD) sells pretty much everything you need to deploy a fiber network, including frames and cabinets, optical components, cable and drop assemblies, terminals and cabinets, and wall boxes.

Clearfield’s customers are broadband service providers, including the large national carriers, local companies, utilities, and municipalities.

There were already huge opportunities for Clearfield from the rollout of 5G and the continued adoption of cloud computing and data centers. Add in government-mandated expansion and updates to the nation’s fiber-optic grid, and business is about to go from good to great.

The latest earnings report gives some idea of just how good the business is right now. Sales were up 45% year over year while the backlog of work rose by more than 100% compared to the first quarter of 2020. Gross profit margins climbed from 39% to 43.6%. As a result of the powerful sales increase combined with margin improvement, earnings exploded from just $0.05 last year to $0.27 this year.

That’s year-over-year earnings growth of more than 400%.

The Semiconductor Stock to Own Now

Our next tech stock to buy for September is Micron Technology Inc. (NASDAQ: MU).

Micron is one of the largest players in the market for computer memory chips. There is enormous demand for its chips from the smartphone and PC markets. 5G and artificial intelligence will also drive demand for memory chips, which should drive additional revenue and earnings.

The demand for 5G phones will explode, and the higher-end phones require more memory than ever.

According to Micron, servers using AI require six times as many memory chips as traditional servers.

We should also see increased demand from the data center markets starting in the second half of the year. Memory usage in autonomous vehicles is going to be enormous as well.

Demand is growing for Micron semiconductor chips, and the company is scrambling to meet the demand.

The burgeoning demand situation has Micron management excited about its prospects for 2021. It expects sales to rise by more than 30%. The surge, along with improved margins, should lead to more than 90% year-over-year earnings growth.

That should send the stock price soaring for the rest of this year.

A Fintech Stock That Is Not Robinhood

The fintech sector is expected to be worth $309 billion next year. And while Robinhood stock makes headlines lately, there are plenty more growth opportunities in other emerging fintech stocks.

You may or may not know this one. But it’s certainly not getting the attention it should.

Money Morning Chief Investment Strategist Shah Gilani recommends Dave.com as one of the top rising fintech stocks out there right now.

This company is not public yet. But it’s on the way to merging with VPC Impact Acquisition Holding III (NYSE: VPCC), which you can buy before the merger happens. VPC is a special purpose acquisition company (SPAC) or “blank check company” that invests in promising startups like Dave.

And Dave is promising. The company offers banking accounts and debit cards with a new spin.

The company pitches itself as a “friend” that can rely on for a small loan when you want to avoid overdrawing your account. Overdraft fees can add up – they average $33.43 in the United States – so the demand is there.

You can link a Dave account to another checking account to bump up your checking account balance with a free advance “to cover upcoming expenses up to $100.”

This $4 billion startup will eventually be listed on the NYSE when the merger is complete. In the meantime, you can buy shares of VPCC and wait for the ticker to change and the value of the stock to soar.

Best Biotech Stock to Buy Now

It’s impossible to talk about tech stocks today without addressing the biotech industry – we’re in a pandemic, after all.

Still, that does not mean the biotech stock to buy now is all that obvious. Besides winners like Moderna Inc. (NASDAQ: MRNA) and Pfizer Inc. (NYSE: PFE) profiting from vaccine research and COVID-19 boosters, you have a sea of other biotechs rushing to beat each other out for the next big innovation.

So, it’s an incredibly volatile sector. But there’s a workaround.

You see, the entire medical industry is about to get a massive shakeup that is not exactly on everyone’s radar. If you don’t know, it’s the latest research into psychedelic medicine that’s setting biotech firms ablaze.

Research has shown that laboratory-derived psychedelics can effectively treat depression, anxiety, PTSD, and a host of other emotional-psychological conditions. Meanwhile, new and old biotechs are popping up with test programs for these drugs.

There’s a market of 284 million people suffering from these afflictions, reportedly leading to $1 trillion in lost productivity. That’s not counting the billions spent on treating these conditions.

That’s why this industry will more likely than not explode in the next few years. Data Bridge Market research says it could more than triple by 2027, from $2.01 billion to $6.86 in value. And who knows what that number will look like 10 years from now.

While it’s a taboo subject, you may remember, we were having this exact same conversation around marijuana just a few years ago. Today, more than 36 states have legalized marijuana, and it will eventually be commonplace nationwide.

Now, only a couple states have legalized psychedelics, which means it’s the perfect time to beat the crowd for profits in these stocks.

But again, similar to marijuana in the early days, this sector is highly competitive. You will see a lot of psychedelic stocks pop up and fizzle out over time.

To get the most bang for your buck out of psychedelics, the SPDR S&P Biotech ETF (NYSEArca: XBI) is a solid, diversified opportunity to profit from the whole industry.

How to Find the Best Tech Stocks to Buy Right Now

To help you find the best stocks to buy, Wall Street Watchdogs gives you insight into which stocks we see as good buys, which stocks should be avoided, and what news matters in the Dow Jones every day.

Growth and Momentum

The best tech stocks to buy now are often stocks with strong upward momentum. One big benefit of buying tech stocks is how much growth potential the sector offers. Some high growth stocks may not be profitable yet are difficult to evaluate using traditional metrics. That is why looking for tech stocks that have been moving higher can be a good indicator that more people want to buy them and that they’re riding a trend. A good way to examine growth and momentum is by evaluating a key piece of technical analysis called the moving average.

• Moving Average – A stock’s moving average (MA) is the average closing price over a certain time period, like 20 days, 50 days, or 200 days. It’s used to get a baseline for where the stock is trading that removes any short-term fluctuations. When a stock is trading above its 20- or 50-day MA, it shows good upward momentum.

Fundamentals

Fundamentals are, simply put, data that can potentially impact the price of a company’s stock. Factors included in a fundamental analysis of a company can include its management of capital, its cash flow, profit retention, funding for growth and research and development, and more.

The fundamentals of technology stocks are an important part of evaluating their potential. This is because well-established tech companies such as Google and Microsoft that boast solid fundamentals have also proven their ability to maintain leadership in their markets.

A valuable fundamental to consider is earnings per share:

• Earnings Per Share (EPS) Growth – Earnings per share refer to the company’s profit divided by its outstanding shares. Strong growth in EPS means a bigger ROI. EPS growth of 25% or more over a 12-month period is a good sign.

Value

A successful track record isn’t always an indicator that a company is offering one of the best tech stocks to buy now. In addition to looking at recent earnings, it’s important to consider the stock’s price-to-earnings ratio (P/E).

P/E compares the price of a share in a company to its earnings per share. A high P/E means that a stock’s price is expensive compared to its earnings and is potentially overvalued.

A low P/E means that a stock is cheap compared to its earnings and could be undervalued. Buying undervalued stocks is an important part of value investing. Each sector has its own “normal” P/E ratio. Tech stocks typically have high P/Es because there’s high future growth anticipated.

How Do I Buy Technology Stocks?

Tech stocks can be purchased just like any other stocks. You can buy stocks in individual companies which you have studied and believe will give you a solid ROI.

Having a hard time dividing which stock is right for you? Maybe you can choose to invest in an ETF or mutual fund. By doing so, you get exposure to multiple stocks that are picked by the fund manager. Funds can be focused on IPOs, companies that give dividends, high-growth companies, specific sectors in the tech sphere, and more.

Although ETFs give you broader exposure to the tech market as a whole, owning the best technology stocks individually offers savvy investors a better chance at making more money than by simply looking into ETFs.

Why Should I Invest in Tech Stocks?

Investing in tech companies is popular because it is an exciting way to profit on some of the fastest growing businesses in the world. Early investors in some of the biggest tech companies have seen massive returns. For example, Amazon stock, which is now worth thousands of dollars, had an IPO of $18.

While not every stock is going to skyrocket the way Amazon has, there is still plenty of room for growth in the tech world and the opportunity for smart investors to pick stocks with a bright future.

Should you invest in SPDR S&P Biotech ETF right now?

Before you consider buying SPDR S&P Biotech ETF, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not SPDR S&P Biotech ETF.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...

You might also like:

- An estimated $2.2 Trillion Move Against China?

- Buy alert: Move $1,000 before Tesla’s Optimus launch

- Trump to “Reset” U.S. Economy on Scale Not Seen in 50 Yrs

- Nvidia CEO Makes First Ever Tesla Announcement

- 2 Nobel Prize winners warn of once-in-a-generation wealth shift…

- [LEAKED] Trump’s Next AI Executive Orders?

- October 2025 Market Crash?

- GOLD… IT’S TIME

- The next biggest bull run in over 50 years

- Is Oracle the new #1 AI Stock Today? Wall Street Legend Weighs In