Second quarter earnings season officially kicks off this week with major financial institutions like Bank of America (BAC) and JPMorgan Chase (JPM) set to report. Expectations are high as profits roared in the second quarter relative to the early days of the pandemic last year.

“With earnings season kicking off next week, the bar is set quite high and corporate America better produce another stellar quarter or there could be some disappointed bulls,” said Ryan Detrick, chief market strategist at LPL Financial, after Friday’s record high.

Investors will also be looking at more evidence on inflation in the coming week with the June consumer-price index set for release Tuesday ahead of opening bell.

Last month’s CPI reading rose 5% on a year-over-year basis – its biggest annual jump since August 2008. And according to Gargi Chaudhuri, head of iShares Investment Strategy, Americas at BlackRock, inflation is going to continue to run hot. This is due to several factors, including the Fed’s easy money policy, higher production costs and supply bottlenecks.

However, Chaudhuri says that the rising-inflation trend bodes well for “cyclically oriented value stocks in sectors such as financials that have been strong performers so far in 2021.”

With all of this in mind, our team has a few recommendations of stocks to watch for next week. Continue reading to find out who.

Focus Financial Partners (FOCS) is a compelling choice from the financial sector right now. The company invests in Registered Investment Advisors (RIAs). There’s a bevy of acquisitions in the wings that are expected to be lucrative for Focus, such as two partner firm mergers in Q2, which will provide about $7 million in organic growth.

Raymond James analyst Patrick O’Shaughnessy recently broke down his bullish standpoint on the financial stock. “Market appreciation and updated margin guidance drive our estimates higher in 2021 and beyond, and with Focus’s leverage trending towards the low end of its targeted range … we could see an acceleration in acquisition activity,” he says. He raised his price target from $59 to $60, indicating a potential 12-month upside of 18.8%. O’Shaughnessy rates the stock a Buy.

In fact, of the 10 analysts offering recommendations for the stock, all ten rate the stock a Buy. There are no Hold or Sell ratings for the stock. A median price target of $60.50 represents a 15.66 increase from the current price.

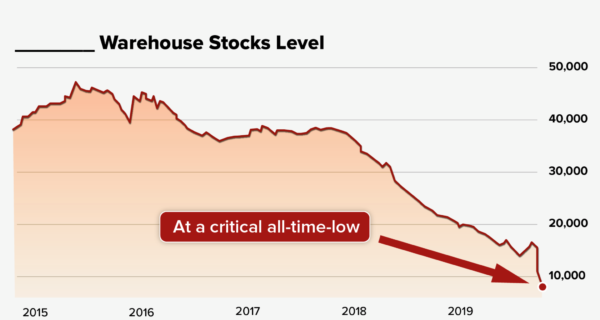

An expanding global population and rapidly moving urbanization are expected to fuel steel demand for years to come. This bodes well for Vale (VALE), the world’s largest producer of iron ore and pellets and supplier of the steel industry.

The firm has been gaining from a rally in iron ore prices, which hit all-time highs in May with supply concerns in China fueling the rise. China, the largest consumer of steel worldwide, is spending more on infrastructure, so the price of iron ore is expected to remain high for the foreseeable future.

Vale doesn’t limit itself to iron though. It produces metallurgical and thermal coal, copper, manganese ore and nickel, which is used in EV batteries. Plus, demand for copper in China may continue to push prices higher in the near term. They also have a logistics network that integrates mines, railroads, ports and ships which has provided an edge in the market as it lowers cost to the company.

Analysts expect sales to surge 115% and earnings to soar 517% year-over-year in the second quarter. Earnings are also expected to surge a whopping 372% for the full fiscal year.

The company is well favored among the Wall Street pros., and gaining attention. Of 21 analysts offering recommendations for VALE 17 rate the stock a Buy, 2 rate it a Hold and only 2 say to Sell VALE shares. A median 12-month price target of 13.84% represents a 14% upside from its current price.

Last up on this week’s watchlist we have Crocs, Inc. (CROX) who is widely known for their casual, comfortable, colorful molded footwear. All Crocs’ shoes feature their signature Croslite’ material, a proprietary, revolutionary technology that gives each pair of shoes the soft, comfortable, lightweight, non-marking and odor-resistant qualities that Crocs fans have known and love.

The company recently announced a partnership with global exports organization Gen.G and are kicking things off with a Minecraft theme build competition called “Build Your Life in Color.”

“The ‘Build Your Life in Color’ competition is another example of how Crocs continues to innovate by creating authentic relationships with brand fans and consumers on the digital stage,” said Crocs SVP & Chief Marketing Officer Heidi Cooley . “Just like Crocs, the world of Minecraft is inspired by creativity and self-expression, and we’re excited to collaborate with Gen.G on a program that brings Crocs together with the gaming community.”

“Working with a brand like Crocs, who routinely makes waves in the fashion and music world, has been a blast. We really challenged ourselves to come up with something cool that celebrates the amazing creativity of the global Minecraft community,” said Gina Chung Lee , CMO of Gen.G.

So far this year, CROX is outpacing bothe the S&P 500 and its Consumer Discretionary peers. The latest available data shows that CROX has returned about 80% since the start of the calendar year versus the S&P’s 18% return. Meanwhile, the Consumer Discretionary sector has returned an average of -1.11% on a year-to-date basis.

Of 10 analysts offering recommendations for CROX stock, 7 rate the stock a Buy and three rate it a Hold. There are no Sell ratings for the stock. A median price target of $130.00 represents a 11% gain from its current price.

Should you invest in Crocs right now?

Before you consider buying Crocs, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Crocs.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...