The major indexes ended mostly lower for the holiday-shortened trading week, with the large-cap benchmarks and technology-heavy Nasdaq Composite index hitting record intraday highs before falling back. An increase in longer-term interest rates weighed on fast-growing technology stocks by raising the discount rate on future earnings. Conversely, the increase favored bank shares by boosting lending margins and helped value shares—heavily weighted in financials—outperform growth stocks. Trading volumes continued to fall back from January’s record levels but were expected to pick up again on Friday, following one of the largest option expiration dates on record. Markets were closed on Monday in observance of Presidents’ Day.

Cryptocurrencies tracked higher this week with Bitcoin price hitting it’s all time high, above $57,000 per coin. Congrats to our community members who bought Bitcoin back when we issued our most recent Buy alert on September 14th, when the price per coin was just above $10,000. Since then the price for BTC has spiked more than 400%.

Continue reading to find out how our stock recommendations performed this week.

02-16-2021_CNC down 2.11%

Centene Corp. (CNC) earns its money managing Medicare and Medicaid contracts. It does this through managed care, in which it controls spending through contracts with front-line clinics, as well as acute care facilities such as dialysis centers, and by controlling drug disbursement.

Centene trades at just 11 times earnings estimates. Part of that is because margins are thin, though, with just 2% of revenues hitting the bottom line. That means growth has to come from acquisitions, from low bids on the exchanges, or from new government health contracts.

The analyst community also throws its weight behind CNC shares. Thirteen of 17 pros covering Centene put it among their best stocks to buy now, with an average $82.15 price target that implies 36% upside from current prices.

02-17-2021_CAT up 3.72%

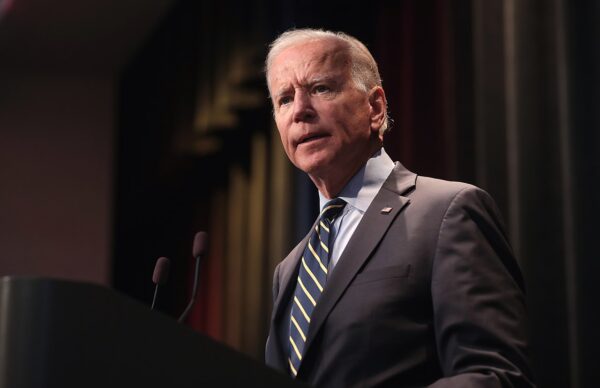

A key plank of President Biden’s platform is his “Build Back Better” plan, which includes pledges to “mobilize American manufacturing” and “build a modern infrastructure.”

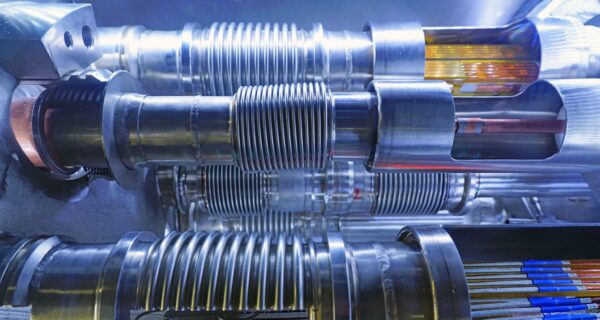

If a boom in infrastructure spending is on the horizon, then it’s hard to avoid Caterpillar (CAT), the world’s leading maker of construction and mining equipment. Caterpillar is not purely a play on American infrastructure, of course. The company has a global presence and should benefit from a recovery in emerging markets as well.

Of 24 analysts offering recommendations 11 rate the stock a Buy. There are also 10 Hold ratings and 3 Sell ratings for CAT stock. The stock currently trades with a trailing twelve month price to earnings ratio of 32.5 and sports a 2.04% dividend yield.

02-18-2021_KGC down 4.66%

Kinross Gold Corp. (KGC) is a Canadian-based gold and silver mining company founded in 1993 and headquartered in Toronto. Kinross currently operates eight active gold mines located in Brazil, Ghana, Mauritania, Russia and The United States. The company was ranked fourth of the “10 Top Gold-mining Companies” 2019 by InvestNews.

The company has seen earnings grow by 65% per year over the last three years and they were up 213% in the third quarter. Analysts expect earnings to rise by 21.6% for the year.

The current valuations for the stock are extremely low with the trailing twelve month P/E at 6.96 and the forward P/E at 9.18 . The company does pay a modest dividend with the current yield being 1.68%.

Of 18 analysts covering the stock, 14 rate the stock a Buy and 4 rate the stock a Hold. There are currently no Sell ratings for KGC stock.

02-19-2021_NTES down 0.35%

NetEase Inc (NTES) develops and operates mobile and PC games, communities, and eCommerce platforms. Its titles include some of the most popular games in China such as the Westward Journey series, Ghost, and partnering with Activision Blizzard (ATVI) to deliver Chinese-versions of Blizzard games to its users.

Over the last ten years, NTES’s revenue has gone from $780 million to $8.7 billion. Next year, earnings are expected to grow by 60% and revenues by 27%. Due to this, NTES has a reasonable forward PE of 30.

NTES’s leading position in the video game market is expected to grow at a double-digit CAGR over the next decade. NTES also has shown the ability to develop and launch new games that are well-received by the public and partner with foreign developers to bring popular games to the Chinese market.

The current consensus among 36 polled analysts is to buy NTES. There are 31 Buy ratings, 4 Hold ratings and only 1 Sell rating for the stock.

NetEase is scheduled to report earnings on February 25th. Recent positive estimate revisions are a good indication that analysts anticipate an earnings beat.

Where to invest $1,000 right now...

Before you consider buying NetEase, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not NetEase.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...