The Nasdaq and the S&P 500 closed at record levels once again yesterday. Futures are pointing to more gains today.

We’re at the tail end of earnings season with just a handful of companies left to report. Investors are piling into one stock in anticipation of their earnings call this afternoon.

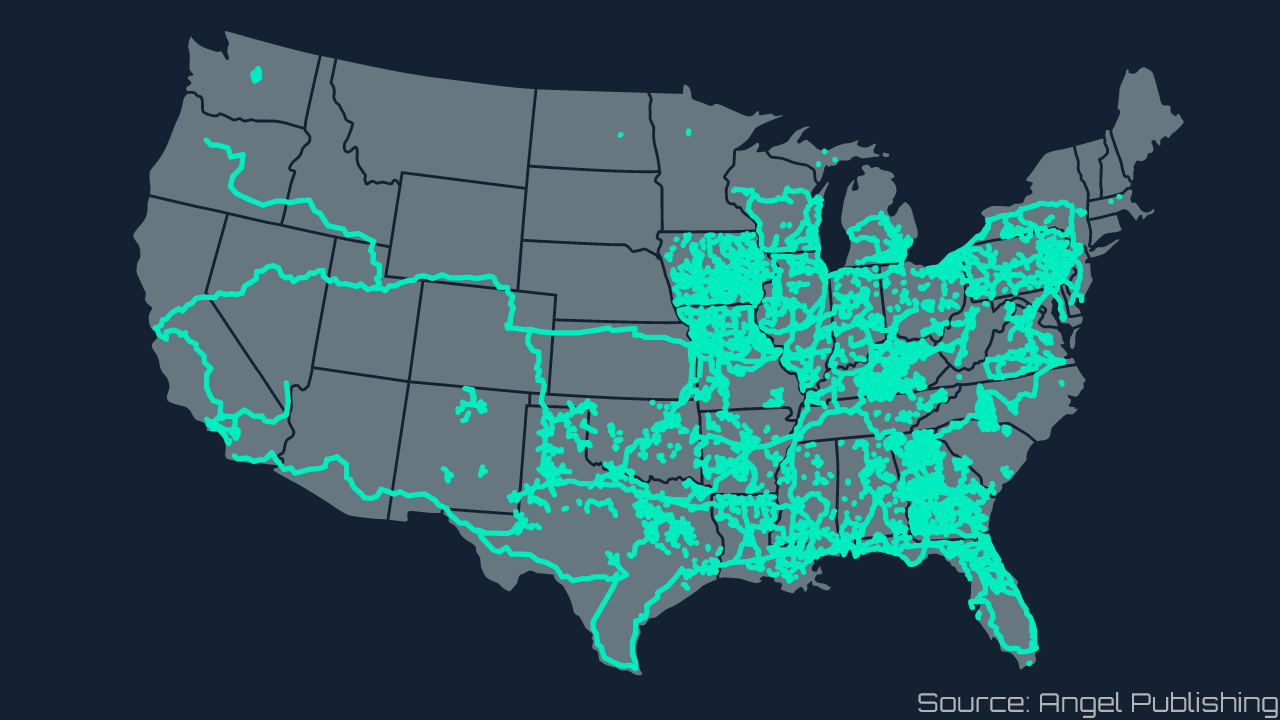

It’s a great time to be a mortgage originator, especially with Rocket Companies’ (RKT) business model. The housing market’s recovery has seen demand for purchase mortgages and refinance loans remain elevated above 2019 levels for months. While some originators struggle to match recent surging demand, Rocket is able to scale because of its tech platform.

What’s more, Rocket’s digital model also allows it to take advantage of another important trend in the market — digital-first millennials. “Rocket is well-positioned to take advantage of favorable demographic trends as millennials enter peak home purchasing age and expect a digital mortgage process,” according to J.P. Morgan analyst, Richard Shane.

Since its initial public offering last month RKT shares have risen 38%. The Quicken Loans parent company released preliminary second-quarter earnings in mid-August as part of financial disclosure to bondholders. The company reported net revenue of $5 billion, a 437% increase from the same quarter in 2019, and adjusted Ebitda of $3.8 billion, up 886% from the second quarter last year. Rocket will report its official earnings today after the closing bell.