In 1929, the Dow Jones exploded 300% between 1923 and 1929, as investors poured billions into the market, creating unjustifiably stretched valuations.

Then, between 1929 and 1932, the Dow Jones lost 86% of its value.

In 2000, the dot-com boom sent the Dow Jones to nearly 11,750. Again, investors poured billions into the market, creating unjustifiably stretched valuations.

The Dow Jones would crash not long after.

In 2008, the Dow Jones exploded to 14,038 on the heels of a housing boom. Again, investors had poured billions into the market, creating unjustifiably stretched valuations.

The Dow Jones would sink to 6,500 not long after.

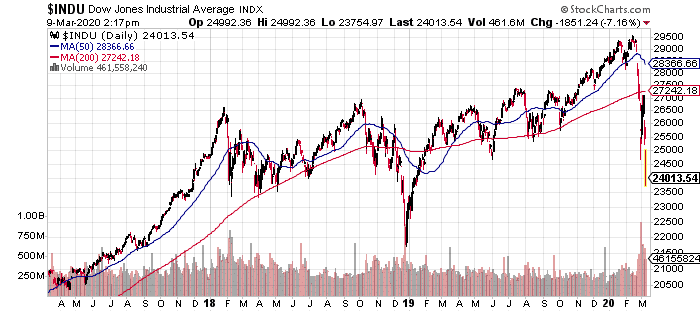

Even today, stocks soared on high levels of optimism and unjustifiable valuations, as investors poured billions into the market.

However, just as we saw in 1929, 2000, 2008, and today, the good times couldn’t last.

All because investors don’t pay attention, only to be blindsided by a monster sell-off.

History told us the good times couldn’t last

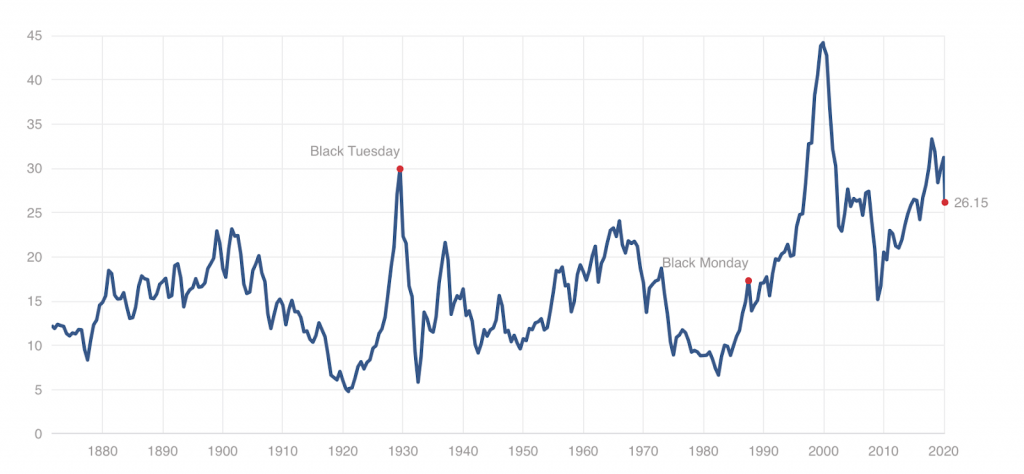

Fundamentally, the Shiller P/E ratio, which examines company valuations over 10 years was higher than it was dating back to Black Tuesday 1929 at 33.

Price to sales ratios sat at highs. Price to book ratios were well above 2008 levels.

“Historically our stock market is fundamentally connected to corporate earnings and the overall GDP, with typical stock price ratios of 15 times earnings and an overall market capitalization of about 0.9 times GDP. Lately, we have been running at 22+ PE ratios and two times the GDP,” said Norm Miller, University of San Diego, as quoted by The San Diego Union Tribune.

“Low interest rates explain part of the higher ratios, but we were due for a correction and the coronavirus provided the trigger,” he added.

Kelly Cunningham, San Diego Institute for Economic Research, added, “Simply comparing the stock market to size of the economy or U.S. equity market cap-to-GDP ratio was at an all-time high. Average price-to-earnings ratio of 18.4 times had also not occurred since the “dot-com” bubble of 2000. This indicated the bulk of increase in stock valuation came not from earnings growth but investors unrealistically valuing or speculating on future growth. If the stock market was not overvalued, the coronavirus would not have as much effect.”

The Coronavirus and Oil Simply Provided the Trigger

Global cases of the infection are now up to 109,000 with at least 3,801 deaths.

And there’s little hope for containment.

“We’re past the point of containment,” Dr. Scott Gottlieb, former commissioner of the Food and Drug Administration said, as quoted by MSN. “We have to implement broad mitigation strategies. The next two weeks are really going to change the complexion in this country. We’ll get through this, but it’s going to be a hard period.”

Italy just locked down 16 million people – more than a quarter of its population to help halt the spread of the virus. Its death toll is now up to 366. Saudi Arabia just imposed a temporary lockdown on the eastern Qatif province. Germany just topped 1,000 cases.

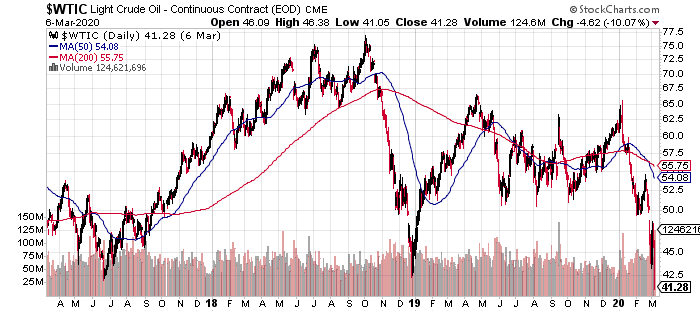

With regards to oil, “The prognosis for the oil market is even more dire than in November 2014, when such a price war last started, as it comes to a head with the significant collapse in oil demand due to the coronavirus. This is the equivalent of a 1Q09 demand shock amid a 2Q15 OPEC production surge for a likely 1Q16 price outcome,” Goldman Sachs oil strategist Damien Courvalin said, as quoted by Yahoo Finance.

“This completely changes the outlook for the oil and gas markets, in our view, and brings back the playbook of the New Oil Order, with low cost producers increasing supply from their spare capacity to force higher cost producers to reduce output.”

All thanks to a new oil price war between OPEC and Russia.

With Russia’s unwillingness to cut its output, the Saudis are preparing to open the spigots. Reportedly, Russia is refusing to go along with OPEC’s proposal to rescue coronavirus-battered oil markets by cutting more production. Because of that, the Saudis cut its April oil selling prices to $8 with hopes this will bring Russia to the table.

If not, ″$20 oil in 2020 is coming,” Ali Khedery, CEO of U.S.-based strategy firm Dragoman Ventures, as quoted by CNBC. “Huge geopolitical implications. Timely stimulus for net consumers. Catastrophic for failed/failing petro-kleptocracies Iraq, Iran, etc – may prove existential 1-2 punch when paired with COVID19.”

The Top 3 Ways Investors Can Prepare for Chaos

ProShares Ultra VIX Short-Term Futures ETF (UVXY)

The ETF was designed to match two times (2x) the daily performance of the S&P 500 VIX Short-Term Futures Index. Since Feb. 27, UXVY jumped from $19 to $47.35.

VelocityShares Daily 2x VIX Short-Term ETN (TVIX)

This ETF tracks an index of futures contracts on the S&P 500 VIX Short-Term Futures Index. TVIX traded around $85 on Feb. 27. It’s now up to $265.

iPath S&P 500 VIX Short-Term Futures (VXX)

The VXX ETN provides exposure to the S&P 500 VIX Short-Term Futures Index Total Return. On Feb. 27, the VXX traded at $22. It’s up to $37.50.